作者:CHARLES

编译:深潮TechFlow

这个周期被一些人称为“ memecoin 周期”,还有人甚至将其称为“ memecoin 超级周期”。我们看到像 WIF 这样的新 memecoin 在几个月内市值从零飙升至数十亿美元。我们还看到围绕 memecoin 现象构建的各种产品,例如 pump.fun 的推出。不管你是否喜欢, memecoin 都无法被忽视。

大多数活跃的加密货币参与者都会深刻地感受到, memecoin 在这个周期中的表现极为出色,作为一个板块,其表现远远超过了其他所有板块。当我们听到交易者通过 memecoin 获得数倍收益的故事时,问题总是:“他们是如何识别出那个特定的 memecoin 的?”当然,这其中有幸存者偏差的成分,但是否还有其他因素在起作用呢?

一般来说,在 HFAResearch,我们专注于从投资、交易和挖矿的角度出发的基本面驱动的想法。这使得我们很难覆盖 memecoin 板块——像 NFT 一样, memecoin 的投资逻辑往往更加模糊,更依赖于“氛围”和迷因本身,这使得基本面分析更加困难。至少,这是我们在发现我们称之为“ Memecoin TVL 拉升理论”之前的想法。

Memecoin TVL 拉升理论认为,主要的 memecoin 或一篮子主要的 memecoin 将作为链上 TVL 的杠杆押注。在我们列举过去的各种例子之前,首先让我们理解为什么这有道理。

我们知道,随着链上 TVL 的增加,某个比例的资金会流入该链上的某些应用或“目的地”……比如 X% 会进入货币市场,Y% 会流入主要的去中心化交易所 (DEX) 等。因此,假设有一小部分资金会希望找到押注该链的最高 beta 方式是合理的。他们怎么做呢?通过购买主要的 memecoin 或一篮子主要的 memecoin 。也许对你们中的一些人来说,这显而易见,但我们认为这提供了一种有价值且可能降低风险的方式来参与 memecoin ,因为它提供了一些“基本面”方法来评估未来 memecoin 的表现(无论是上涨还是下跌)。

让我们来看几个历史上这种情况的例子:

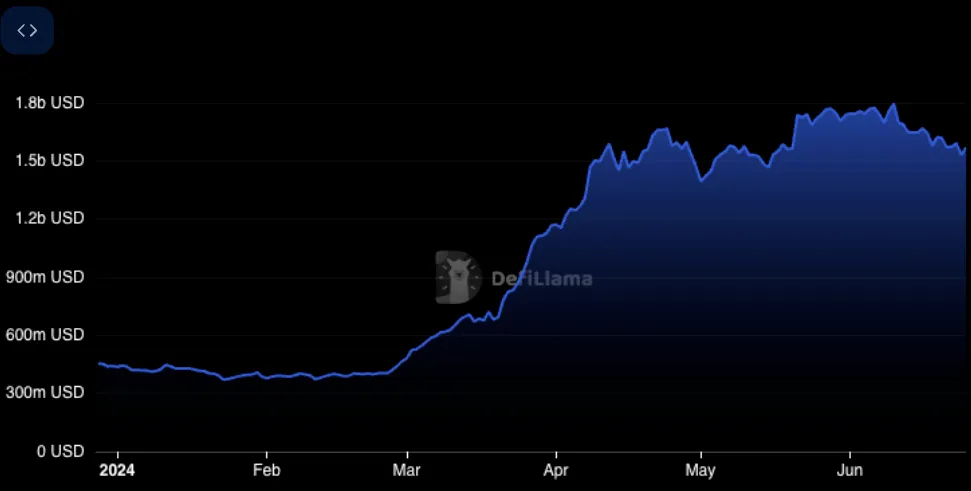

Base

Base TVL

TOSHI 的表现开始与 Base TVL 在三月的增长同步

BRETT 的两次抛物线式价格上涨都发生在 Base TVL 的上升趋势期间

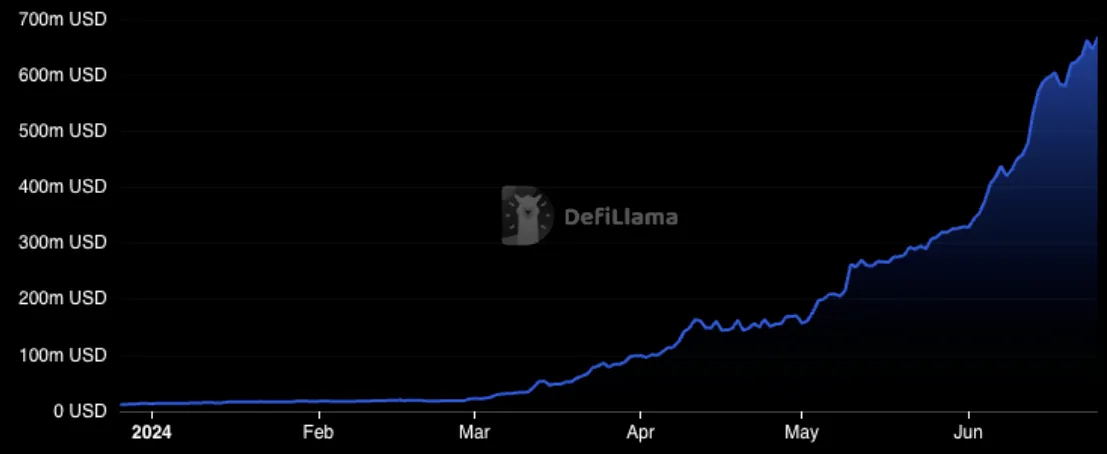

TON

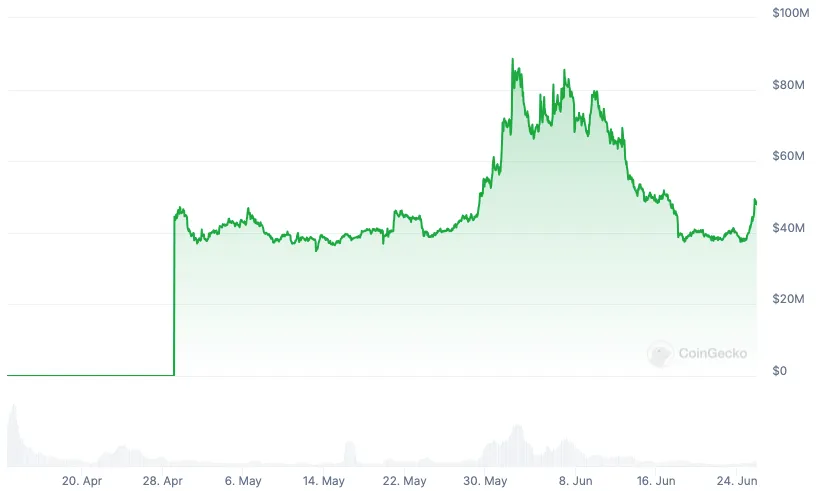

TON TVL

REDO 是 TON 网络上的主要 memecoin

上述例子清楚地表明;TVL 流入 = 主要 memecoin 表现。如果能预测 TVL 增加,那么可以在该链上的主要 memecoin 上持仓,作为对 TVL 预测的杠杆押注。

对这种策略持批评意见的人会说,这种策略的设计会降低收益,因为它需要知道哪个是最重要的 memecoin,才能确定 TVL 的流向。这种批评是有道理的,这种策略当然不允许在 10 万美元市值时狙击一个 memecoin,并使其上涨 1000 倍至 1 亿美元,但它可以非常有效地找到一些稍大、稍成熟的 memecoin,并使其从那里开始上涨。例如,在 2 月下旬至 4 月上旬期间,Base 经历了 TVL 抛物线式的运行,Toshi 从 4000 万美元的市值涨到了 3 亿多美元的市值,在不到 2 个月的时间里几乎没有乏善可陈的回报。

预测 TVL 的增长可分为两类:长期和短期。长期预测实际上就是预测 TVL 在多个月内的流向。我们可能会指出,Base 将 Coinbase 作为零售用户上机的漏斗,这就是 TVL 增长将保持稳定的原因。我们可以看看 TON 和 Telegram 之间近乎乱伦的密切关系,以了解所有 9 亿 Telegram 月活跃用户上链对 TVL 的影响。我们可能会提到 Solana 及其卓越的链式用户体验和移动钱包,并以此为理由相信 TVL 也会加入其中。你明白我的意思了;从长远来看,要预测 TVL 在更长时间跨度内的增长,就必须研究链上更深层次的分销基础。然后,您将研究该链上的主要 memecoin 或 memecoin,并据此下注。

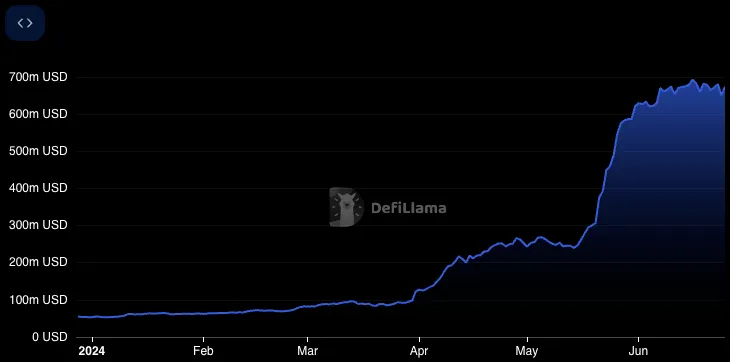

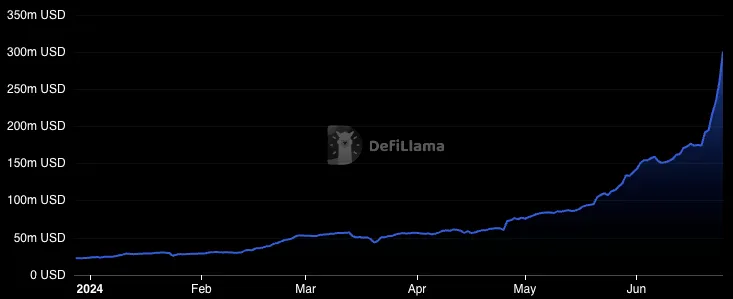

短期方法将积分计划或空投等短期催化剂视为 TVL 增长的原因。例如,作为 Linea 上首屈一指的 memecoin,$FOXY 在宣布其激增积分计划后,在随之而来的 TVL 流入中表现极为出色:

Linea TVL、Surge 于 5 月中旬发布

$FOXY 市值

短期方法需要更积极地关注市场,以及资本可能会根据激励计划流向何处。这与我们中的一些人在上个周期玩的游戏比较类似;进入新链上的顶级 DEX 的 2 号池,以此来押注激励计划带来的 TVL 增长。

一个更具体的例子是 Scroll。在引入其最新的积分计划后,我们已经看到其 TVL 呈现出爆发式增长。Scroll 会成为短期策略的下一个理想目标吗?

我们认为这种方法提供了一种更系统化且风险更低的方式来参与 memecoin 板块,但我们在这个领域还算新手,所以希望听到你的反馈!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。