师爷聊热点:

本周宏观看点,美国6月非农会不会如期大幅降温,鲍威尔、拉加德将在欧洲央行论坛发表讲话,多国将发布PMI数据,美联储将公布最新会议纪要。此外,关注2024世界人工智能大会、英国和法国大选。

上周比特币ETF净流入7300万,保持连续4天流入的良好状态。不过考虑每天流入资金都比较少,整个上周共计流入只有3730万。

当然好消息是贝莱德终于结束了连续10天0流入状态,后面贝莱德这个绝对龙头能否继续买买买是本周行情走势的关键因素。

而以太坊ETF消息不少,一是sec审核继续,已经将S-1表格推给发行商了,并且附带少量评论。看这样子应该是还要一轮的审核,所以彭博社分析师将ETF通过时间推迟到7月8号。

昨日师爷文章中在62400-62800区间预埋做多,行情在昨日晚间9点最低跌至62500附近。随后最高反弹到了63849附近,文章中多单拿下1000点利润!

师爷看趋势:

BTC4小时:

比特币目前突破了长期下行趋势线并持续上涨,师爷认为在近期也可以期待N形上涨,并保持短期反弹的观点。

如果RSI指标接近了超卖区域,考虑到短期调整,在调整区间中寻找反弹的机会进行交易是不错的选择。

而市场普遍认为这是低点后的反弹区间,可能会有买盘入场。但在没有利好消息的反弹中,建议逆势操作。

阻力位参考:

第一阻力位:63400

第二阻力位:64380

在突破第1阻力位的区间内,64K再测试的概率也会增加,所以可以期待一波小幅上涨。

由于当前正在测试高点,建议可以关注高点测试是否成功,并观察其是否会形成旗形模式。

支撑位参考:

第一支撑位:62600

第二支撑位:62000

第1支撑位是上涨后的低点区域,因此必须守住企稳才能保持短期反弹的观点。

如果跌破第1支撑位,由于低点降低也将会出现进一步调整,所以在62K时也是一个盈亏比合适的买入区域。

今日交易建议:

在今天的交易中,图表已转为上升趋势,并保持反弹的观点。

关注60日移动平均线的走势,如果调整时成交量较小,第1、第2支撑位可视为买入机会,师爷认为这也是一个盈亏比合适的买入区域。

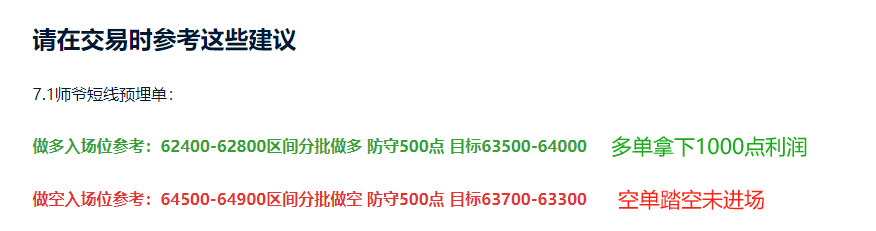

请在交易时参考这些建议

7.2师爷短线预埋单:

做多入场位参考:61600-62000区间分批做多 防守500点 目标62600-63400

做空入场位参考:64380-64780区间分批做空 防守500点 目标63400-62600

本文内容由师爷陈(公众号:币神师爷陈)独家策划发布,如需了解更多实时投资策略、解套、现货合约交易手法、操作技巧以及K线等知识可以加到师爷陈学习交流,希望能帮助到你在币圈找到自己想要的。专注BTC、ETH及山寨币现货合约多年,没有100%的方法,只有100%的顺势而为;每日全网更新宏观面分析文章,主流币及山寨币技术指标分析及现货中长线复盘价格预测视频。

温馨提示:本文只有专栏公众号(上图)是师爷陈所写,文章末尾及评论区其他广.告均与笔者本人无关!!请大家谨慎辨别真假,感谢阅读。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。