作者 | 律动BlockBeats

出品|白话区块链(ID:hellobtc)

6 月 27 日,VanEck 数字资产研究主管 Matthew Sigel 表示已向 SEC 申请 Solana ETF。

这只新基金名为 VanEck Solana Trust,是首个在美国申请的 Solana ETF,他表示:「原生Token SOL 的功能与比特币和以太坊等其他数字商品类似,用于支付区块链上的交易费和计算服务,与以太坊网络上的 ETH 一样,SOL 可以在数字资产平台上交易或用于点对点交易。

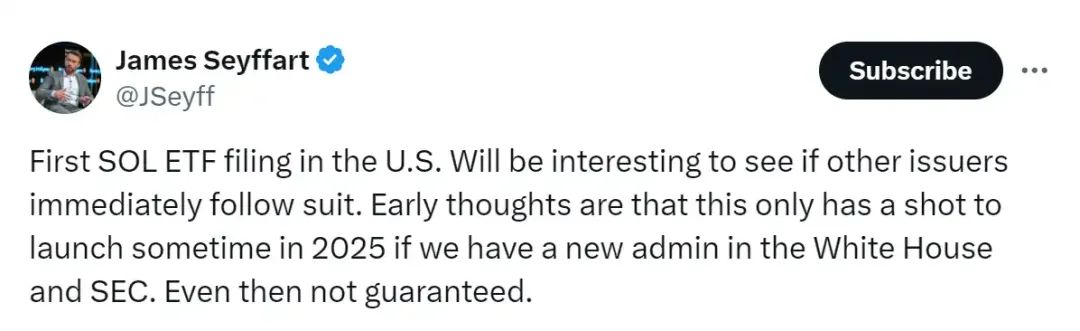

彭博社 ETF 分析师 James Seyffart 在社交媒体上发文表示,Solana ETF 比想象中「来的更早」,但通过率仍是未知数。无论通过与否,这足以让沉寂的加密社区兴奋,毕竟这一轮市场可谓是 ETF 牛市。

译文:首个 SOL ETF 在美国提交申请,很有趣的是,是否会有其他发行机构立即效仿?初步认为,这个 ETF 可能要到 2025 年才有机会推出,前提是届时白宫和 SEC 有新管理层。但即便如此,也不能保证一定会推出。

01、「比特币独牛」

在现货 ETF 通过后,BTC 作为数字资产代表,成为圈内首个「逻辑跑通」的标的。

比特币现货 ETF 让华尔街有了一个正规渠道可以配置加密资产,为加密市场带来大量场外资金。从比特币上涨关键节点也可以看出,从两万五美元到六万九美元新高几乎全都是由 ETF 推动的,无论是诉讼胜利、还是假新闻,消息面的刺激一直牵动着市场的心。

2023 年 8 月 30 日,灰度赢得与 SEC 的诉讼,推翻了 SEC 阻止灰度 ETF 的决定。随着 10 月比特币现货 ETF 通过的假新闻发酵,比特币站稳了 34000 美元。1 月 11 日,SEC 同时通过了 11 支现货比特币 ETF,当日比特币价格冲高至 48590 美元。

春节过后,比特币开启狂暴上涨模式,在踏过了六万九美元大关后,比特币市值达 1.35 万亿美元,超过 Meta Platforms 跃升至全球主流资产市值第 9 位。

数据显示,1 月 21 日至 26 日,比特币 ETF 总资产管理规模在 5 天的时间里从 291.60 亿美元下降至 260.62 亿美元,流失了超 30 亿美元。而自 2 月起,比特币 ETF 总资产管理规模从 283 亿美元开始稳步上升,在不到一个月的时间里突破了 400 亿美元。

随着资金大量流入,比特币的价格迎来了大跨步上涨,整个 2 月,比特币的价格迎来有史以来最大的波动,每枚比特币价格上涨了 18615 美元,这比 15 个月前的比特币价值还要高。

与之相比,山寨在追赶 BTC 上涨的过程中显得十分吃力。以太坊生态的重大利好坎昆升级被冲淡,solana 凭借 Memecoin 绚丽登场,但由此诞生预售、名人币等持续扰乱着市场走向,加之 pumpfun 的崛起更是让 Meme 进一步瓜分了市场注意力,加密 VC 不断被高盈利的 Meme 和 Airdrop 乱象挤到散户的对立面。

而与此同时,以符文为首的比特币生态一直在强势发展。由于没有清晰的商业模式和资产逻辑,许多人认为这个周期是比特币的「独牛」。

02、BlackRock Wants,BlackRock Gets

如果硬要给这一轮牛市找一个开启的理由,那这个理由一定是贝莱德(英文名BlackRock)。在市场处于深熊状态、行业面临高压监管的背景下,贝莱德的 ETF 只手扭转了加密市场的局面。

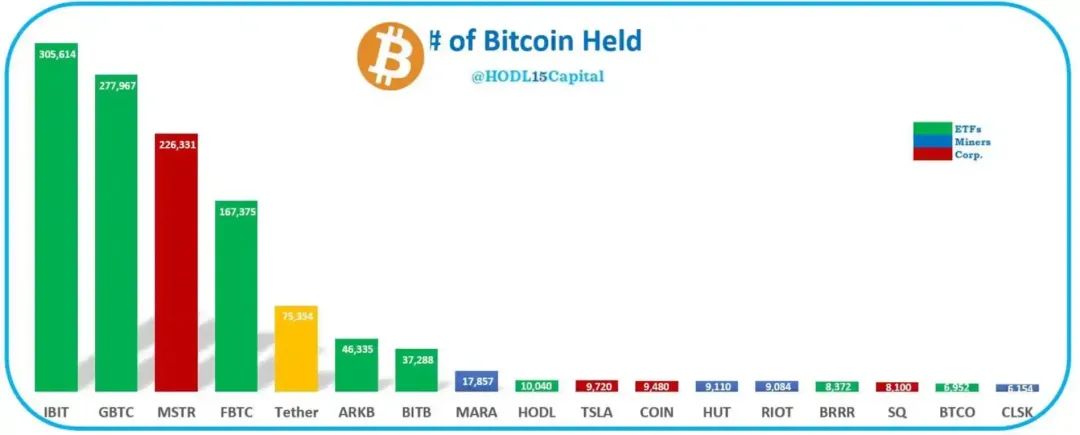

在比特币现货 ETF 上线后,IBIT 也是表现最强劲,流动性最好的那一只。上周,HODL15Capital 列出截至目前全球持有比特币的十大公司中,贝莱德的 IBIT 以 305614 枚 BTC 位列榜首。

在华尔街流传一句话:「BlackRock Wants,BlackRock Gets」。作为掌管 10 万亿美元资产的金融巨头,SEC 在贝莱德面前似乎也得让一让。

很多人没看清的是,上线比特币现货 ETF,或许只是金融巨鳄在Token化世界布局的开胃菜。

2022 年底,贝莱德 CEO Larry Fink 就曾表示:「下一代市场,下一代证券,将是证券的Token化」。贝莱德入驻比特币,格局比我们想的要大得多。随后我们看到的,是贝莱德推出的美元机构数字流动性基金 BUIDL 基金在以太坊上线。

4 月 30 日,贝莱德与 Securitize 合作推出的首个数字化资产基金 BUIDL,在仅六周内成功登顶,占据了总规模为 13 亿美元的数字化国库市场近 30% 的份额。

今年以来Token化美国国债市值大幅增长,Token化 RWA(包括国债、债券和现金等价物)在这两个月里增长了 35%。其中领涨的是贝莱德的 BUIDL,自本季度初以来已增长 65%,推动oken化国债总市值超过 15 亿美元。同期,领先的 RWA 重点 DeFi 协议之一 Ondo Finance 的总锁定价值从 4 月份的 2.21 亿美元增至 5.07 亿美元。

就在 BUIDL 推出后不到一个月,在质押(Staking)方面带有监管问题的以太坊现货 ETF 上演戏剧性大反转,一次申请直接通过。

5 月 24 日,以太坊现货 ETF 从无人看好、通过率仅有 7% 到一夜之间通过率飙升至 75%,ETH 价格也屡屡突破 3800 美元关口。

在 2022 年 9 月以太坊转向称为「权益证明(POS)」的新治理模式后,美国证券交易委员会 (SEC) 对总部位于瑞士的以太坊基金会开启了调查。「权益证明」在事实上为 SEC 提供了一个新的借口来尝试将以太坊定义为一种证券。

作为妥协,贝莱德等申请 ETF 的公司在其 ETF 提案中删除了质押部分,表示不会质押信托的部分资产。5 月 30 日,贝莱德又在向 SEC 提交的文件中表示,将购入 1000 万美元的 ETH 来为其以太坊 ETF 提供资金。

贝莱德三板斧下来,过去一年因为 SEC 带给行业的诸多困难开始被化解。大哥带头冲锋,后面一连串小弟跟着吃肉,一个贝莱德带出无数个机构入场布局,「加密逻辑/加密术语」主流化进程出现新局面。

03

山寨币,ETF 资金也罩得住?

是否还有山寨币牛市,是圈内过去半年一直在讨论的问题。

一方面,VC 资金体量大,新散户入场不及预期,资金难以承接住新币和仍然存活在市场上的老Token,导致项目估值上涨均发生在一级市场,Token上线后出现高 FDV 低流通的情况。其次,由于上一轮牛市应用饱和导致区块空间「过载」,VC 在熊市期间的资金部署主要集中在基础设施领域,使得用户感知最明显的应用层发展滞后,在市场突然迎来行情时呈现出「叙事贫瘠」的问题。

但归根结底,大家最担心的,还是从比特币 ETF 进来的钱,流不到山寨币里。

上一轮周期,加密机构通过将 BTC 抵押、上杠杆,然后这些杠杆资金流到山寨币市场,从而推动整体加密市值增长,带来所谓山寨币牛市。但本周期显然逻辑变了,现货 ETF 由托管机构托管,且无法进行杠杆操作,这直接杀死了山寨币市场的重要资金来源。

不过,本月 ETH 和 SOL 现货 ETF 的新动向,为加密行业吸引和创造流动性带来了更新、更清晰的逻辑,ETF 资金不会只有比特币独享,山寨币也罩的住。

但接下来的问题是,资本市场的消费者,会为比特币之外的加密资产买单吗?

短期来看可能有难度,世界对加密货币的普遍认知仍然是比特币,对于智能合约、以太坊和 Solana 的区别等等概念,还需要一段时间去消化,但这正是贝莱德等机构的商机所在(打包加密 Index)。

相对的,传统机构的入场可能导致许多加密原生机构的市场逐渐被挤压,尤其是做市商和 OTC(场外交易)这一类角色,正规军能带来资金,但也能抢你饭碗。

总言之,不管 SOL ETF 通不通过、ETH ETF 未来表现如何,ETF 牛市的逻辑和趋势似乎已经不可阻挡的来了。

原文来源:https://www.theblockbeats.info/news/54010

END

上一篇:以太坊创始人V神常“点赞”的项目和赛道大盘点

推荐阅读

牛市远去?别慌,2024 下半场的这些剧情仍值得期待

全球比特币ETF持仓突破100万枚,头部持仓机构都有哪些?

比特币钱包、交易所又出事了?千万级资金被盗,大佬也翻车

“玩转比特币”的“加密总统”队伍正在壮大,新的全球共识要来了吗?

特朗普与拜登竞相"拉拢比特币",美国加密监管要巨轮转向了吗?

『声明:本文为作者独立观点,不代表白话区块链立场,本内容仅供广大加密爱好者科普学习和交流,不构成投资意见或建议,请理性看待,树立正确的理念,提高风险意识。文章版权和最终解释权归白话区块链所有。』

喜欢请点「在看」?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。