Ordinals 浪潮与减半之后,上万亿美元的沉睡 BTC 资金池,亟待兼顾安全性与经济性的盘活方案。

撰文:Tyler

2023 年,无疑是比特币生态的转折点。

从以太坊及公链生态出现之后,无论是 2017 年的 ICO 狂潮,抑或是 2020 年的 DeFi 盛夏,以及随后的 NFT 叙事,历年来几乎每一次的业内狂欢都鲜见比特币的身影,甚至渐渐有撇下比特币生态单独起舞的趋势。

直到 2023 年 Ordinals 热潮大爆发,BTC 才终于不再缺席,并彻底改变了比特币的整体费率模型,而伴随着第四次减半的尘埃落地,其网络运行进一步依赖手续费收入,这无疑会深刻影响比特币的可编程性与链上生态建设。

在此背景之下,本文我们就将围绕比特币的可编程性之问,针对 Rollux 的比特币 L2 解决方案进行阐述,一览 Rollux 能否借势比特币的整体费率模型演变趋势,盘活 Holder 们手中的 BTC 这个最优质、体量最大的加密原生资产,进而搅动这个可能高达千亿美元想象空间的新赛道。

比特币 L2 之问:如何撬动沉睡的 BTC 资产

增量是 Web3 破局的核心原语,所以去年下半年以来,比特币 L2 大潮才方兴未艾。

毕竟 2023 年之前,比特币一度被排除在 DeFi、NFT 等创新浪潮之外,只占有「道统认知」和总市值优势,但 2023 年 Ordinals 所催生的铭文潮,不仅直接提高了比特币生态的新资产丰富度,还将天量的资金、用户、开发者通过铭文这条管道引入比特币生态。

更关键的是,Ordinals 及比特币 L2 叙事的大热,也终于让市场意识到,1.13 万亿美元体量的比特币(2024 年 5 月 2 日最新 CoinGecko 数据),正是加密世界最大的「沉睡资金池」,只不过比特币的「可编程性」,正是盘活这万亿美元资产的最大绊脚石:

比特币原链无法承载更大资金与更丰富用例,譬如创建 Swap、借贷、流动性挖矿等一系列应用。而万亿美元的沉睡 BTC,即使只撬动 10%-20%,就会造就一个数千亿美元级别的堪称庞然大物的加密新赛道。

Pantera 合伙人 Franklin Bi 在《重新审视比特币的可编程性》一文中就明确指出,如果 DeFi 在比特币上达到与以太坊上相同的比例,预计比特币上 DeFi 应用的总价值将达到 2250 亿美元(比特币市值的 25%),随着时间的推移,其规模可能在 720 亿美元到 4500 亿美元之间波动(8% 和 50%)。

在此背景之下,比特币的可编程性浪潮逐步成为加密世界的核心议题,在当前比特币生态上构建一个繁荣的 DeFi 应用层,更注定会是主流的新热点叙事。

市场也在积极转向,近半年来,除了 Stacks、RSK、Liquid 等大家耳熟能详的老项目之外,BitVM、Merlin、B² Network 以至于 Nervos 等新方案也提供了全新的思路,这些 L2 就旨在借助可编程性创建 Swap、借贷、流动性挖矿等一系列 DeFi 应用,从而撬动沉睡的万亿美元级别的 BTC 资产。

但实话实说,历史总是在重复地造轮子,早在 2020 年 DeFi Summer 中,关于释放比特币资产流动性的尝试就有很多,其中最主要的一种就是桥接到以太坊生态——以「封装」的形式质押 BTC,像当年 DeFi 浪潮中的 renBTC、WBTC、tBTC,用户可以质押 BTC,获得对应的封装代币,从而作为流动性桥接至以太坊生态,通过与以太坊生态耦合来参与 DeFi 等链上场景。

这种「跨链桥 +EVM」的形式,其实也是目前绝大多数所谓比特币 L2 的核心玩法,但问题在于这样的解决方案真的对 BTC Holder 有吸引力么?

未必。

本质上讲,目前集中涌现的这些比特币 L2 项目都有巨大的同质化风险,甚至一半以上的新项目注定会失败——发展它们需要源源不断的资金来帮助扩展生态与开发人员社区,而在如今的大背景之下,绝大部分比特币 L2 新秀都缺乏这份长线竞争力。

此外,相较于 DeFi 等复杂的链上乐高组合玩法,很多 BTC OG 或 Maxi 没有动力也不敢冒着风险将太多 BTC 跨链到以太坊生态去博未知的收益——对他们来说,失去高收益机会,失去很多,但失去安全性,无疑意味着失去一切。

故比特币 L2 的核心发力点,就是一定要解决以太坊没有解决的问题,实现差异化竞争,从这个角度来看,如何能够在兼顾安全性与,打开比特币编程性的叙事空间,似乎才是盘活比特币这个沉睡的万亿美元加密资产池的关键。

而 Rollux 的思路,也正在于此——作为 Syscoin 推出的基于比特币联合挖矿的 EVM 兼容网络,Rollux 的核心定位就是「共享比特币安全性的 EVM L2 扩展方案」,也即通过比特币矿工和 Syscoin 的 L1 数据可用性(DA)来维护网络安全。

如何安全地激活比特币的可编程性?

那我们就以 Rollux 为例进行剖析,来一探究竟该如何安全地激活比特币的可编程性?

笔者理解,如果用一句话概括 Rollux 的核心架构,那它本质上其实是提供了一个基于 BTC 原生安全性的 EVM 兼容解决方案,也就是说在安全上绑定比特币,而在生态上则看齐 EVM 生态,所以可视为兼容 EVM 的 BTC 智能合约层。

安全上绑定比特币

我们需要先明确一个前提,目前市面上的绝大部分所谓「比特币 L2」,核心还是 PoS 链的思路——安全性本质是来源于其质押资产的可罚没性:如果质押者(或接受其代理的验证节点)攻击 PoS 网络共识,从而试图使其分叉,则其质押资产将被全部或部分罚没。

这无疑远远低于比特币 PoW 链的安全性,所以 Rollux 另辟蹊径,选择在安全上直接绑定比特币,将自己的安全性提升到了和比特币原链一个数量级的独一档水平,从而彻底打消了 BTC OG 或 Maxi 们的入场疑虑。

那它是如何做到在既不要求比特币网络升级分叉,也不需要跨链桥的前提下,实现比特币的原链安全性绑定的呢?

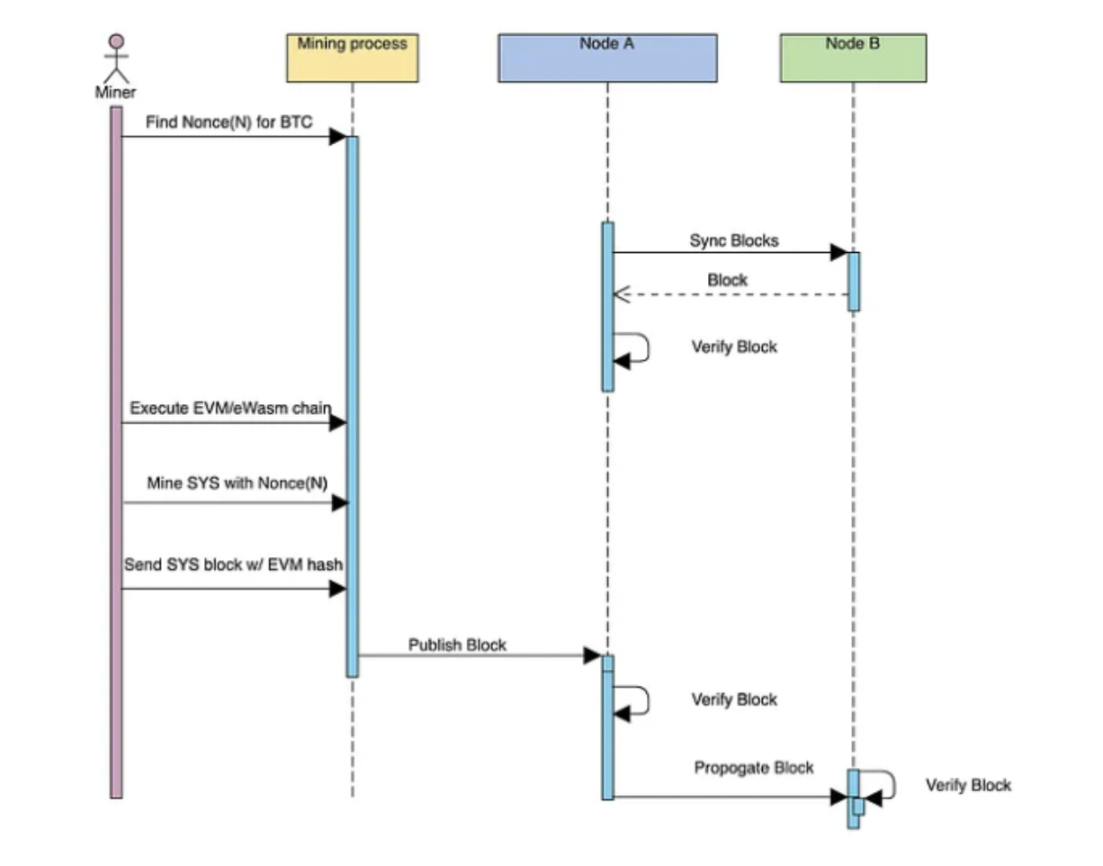

实现逻辑也很简单,就是借助于「联合挖矿」的机制设计——Rollux 联合挖矿缘于 Syscoin,因为 Rollux 是一个运行在 Syscoin NEVM(网络增强型虚拟机)之上的 Optimistic Rollup,故和 Syscoin 一样共享比特币矿工提供的安全性:

其中 Syscoin 网络采用双链架构运行,两个并行运行的区块链在 Syscoin Core 中同时进行联合挖矿——Syscoin UTXO(比特币标准)、Syscoin NEVM(以太坊标准)。

截至 2022 年 4 月,它已经获得了比特币网络约 60% 的哈希率支持,这在某种程度上是直接将比特币的网络算力转化为自己的安全性保障,从底层获得了天然的安全性优势。

生态上则看齐 EVM 生态

其次,由于 Rollux 是运行在 Syscoin NEVM(网络增强型虚拟机)之上的 Optimistic Rollup,因此本质上受益于 EVM 生态提供的跨链互操作性服务:

通过兼容 EVM 允许基于以太坊的开发者、既有应用迁移,有利于生态的进一步扩张,便于开发人员部署产品,从而迅速打开局面。

譬如原先以太坊、Arbitrum、Optimism 等 EVM 网络的 DApp 开发者可以直接无缝迁移到 Rollux,并在 Rollux 上快速搭建 Swap 甚至借贷、流动性质押等链上 DeFi 场景,为生态带来更多的可能性。

也就是说大量的比特币网络资产可被引导到 Rollux 智能合约生态系统中,促进流动性的释放,从而允许用户通过 Rollux 参与各种智能合约应用,如质押、DeFi、社交,甚至更复杂的金融衍生品市场,大大扩展了比特币资产的范围和价值。

这就可与以太坊等多链 EVM 生态耦合,譬如支持在类 Curve 应用中组建 USDT/USDC 池,在类 Uniswap 应用中兑换其他加密资产或组 LP,在类 Aave 应用等借贷协议中抵押借出加密资产等等,以获取 DeFi 等多样化场景的耕作收益。

除此之外,Rollux 的数据可用性方案也为其链上生态建设的经济性大开绿灯,核心抓手则是基于 Syscoin 推出的 BitcoinDA 协议(即 PoDA)——通过与基于 ZK 的互操作协议 zkBridge 合作,使得 Rollux 共享比特币安全性的同时,也能够获得极低的交易、使用成本体验。

其中作为一种可扩展的 DA,BitcoinDA 专为各种 Rollup 设计,以通过实现 L1 的数据可用性来保护各式 L2,但与以太坊的 Proto-Danksharding 和 Celestia 相比,它在数据的存储、呈现、修剪方式以及费用的计算方式上又有所不同:

默认情况下,完整数据 blob 的 Keccak256 哈希存储在 L1 ,同时假设世界上至少有一个诚实方将在至少 6 小时的时间窗口内存档该 blob。

这本质上类似于同步比特币节点(至少一个诚实节点)时做出的诚实假设,而在此时间窗口之后,blob 将从网络缓存中修剪,而其哈希值仍保留在链上。

整个流程其实是一个「四步走」的逻辑:

- 获得 stBTC,比特币矿工可以凭借正常挖矿获得与比特币难度相当的收益 stBTC,且没有 Slash 风险,为后续步骤奠定安全基础;

- 创建并运行 Eigen 层,然后创建并运行一个具有两种特定 AVS 服务的 Eigen 层——跨链服务和 DA 服务,二者都使用 stBTC 来提供安全性;

- 收入和安全性增强,随着需求增加,安全性也会提高,并为比特币持有者创造收入,所以理论上讲,这将形成一个正向循环,激励更多人支持 Eigen 服务并提供安全性;

- 全链模块化比特币层,最后使用 ZK 轻客户端将 BitcoinDA + EigenDA 提供给其他执行环境,这些环境可以验证链并检查 DA 消息,然后再进行自己的 Rollup 状态转换,既确保了基于比特币网络的最佳安全性,也在保持去中心化逻辑的前提下实行了模块化架构。

简言之,通过这一架构,Rollux 既克服了比特币链上无法通过智能合约来实现海量用例的障碍,又能够保障和比特币原链一样的安全性,从而有望在不逊于原链安全的前提下,实现了比特币资产价值的最大化。

Rollux 的比特币增量野望

总的来说,Rollux 将比特币的优势与模块化架构(DA 层 + 执行层 + 跨链桥)相结合,为比特币生态系统提供了一个可扩展、安全且通用的解决方案。

在此基础上,Rollux 罕见地兼顾了安全性与经济性——L0 层面由由比特币矿工提供安全保护,L1 层面通过 BitcoinDA 提供数据可用性,然后为为其他区块链提供 L2 服务(创建 L3/L4 或超级链生态),并创造新的收入来源。

也正因如此,凭借安全性和去中心化特性,Rollux 甚至有望成为其它 Rollup L2 们的理想结算层:

- 通过 Eigen 层和 stBTC,提高可扩展性和收益率,吸引更多用户和开发者;

- 无需在比特币本身上进行直接的乐观博弈,降低复杂性和风险;

其中 Rollux 通过 EVM 兼容的智能合约链架构,大量区块链网络资产可以通过跨链直接被引导到由比特币安全性提供保障的 Rollux 智能合约生态系统中,促进了大量流动性的释放:

- 用户可以通过 Rollux 参与各种智能合约应用,如质押、DeFi、社交,甚至更复杂的金融衍生品市场,大大扩展了比特币资产的范围和价值。

- 开发者维度,EigenDA 可以提供高达 10MB/ 秒或 16.4 万 TPS 的交易速度,BitcoinDA 又可以实现比目前 Dencun 升级后激活 EIP-4844 的 L2 更便宜的链上交易费用;

从这个角度看,Rollux 的更大愿景在于成为「比特币 L2 们的模块化基础设施」——可以为任何比特币 L2 提供支持,特别是从跨链开始,然后为那些希望以最合理的方式大幅提高 TPS 的项目提供 DA 服务 + 安全性服务。

这或将有助于解决比特币 L2 时代的流动性碎片化问题,整合 BTC 全链流动性,推动比特币生态的进一步发展。

同时,Rollux 也将在今日的 Bitcoin Asia 2024 香港比特币峰会主办「BITCOIN'S ORBIT」活动,邀请了 Alex、Bitlayer、BOB、Core 等一众头部玩家共商比特币生态叙事的长线趋势。

按此远景,Rollux 料将能够打通 BTC L2 等多链生态之间的流动性鸿沟,从而使 Rollux 不仅成为支持比特币资产的最安全 L2,还将成为连接比特币多 L2 生态的智能路由:

其它比特币 L2 上的资产可以快速跨链到 Rollux 上,实现多元化的应用场景;比特币网络和 Rollux 链上的资产也可以快速地跨链到任意比特币智能合约链并使用其丰富的 DAPP 生态。

凡是过去,皆为序章。2023 年的 BRC20 浪潮相当于为比特币链上生态的爆发提前做了一次预演,后续无论是否成功,伴随着后续比特币整体费率模型的改变,这条路上的变量势必会深刻改变比特币的生态面貌。

上万亿美元的沉睡资产,接下来会如何走向,还是未知之数。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。