Last week, although the cryptocurrency market experienced local fluctuations, the increase in investment and financing activities indicates the vitality and long-term growth potential within the industry.

By MIIX Captial

Federal Reserve Chairman Powell hinted at the unlikelihood of a short-term interest rate hike, leading to a general rise in global risk asset markets. Additionally, with the US non-farm payroll data falling below expectations, the potential shift from a leisurely pace to a sprint in the Fed's interest rate reduction path is expected to drive a surge in stocks, cryptocurrencies, and bonds, while weakening the US dollar, gold, and crude oil.

1. Investment and Financing Observations

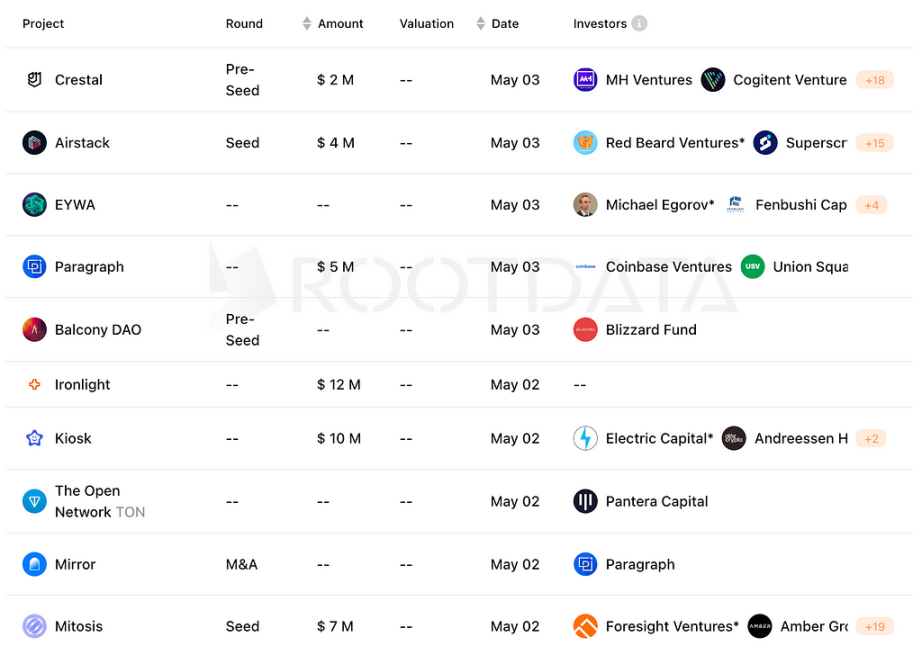

Last week, the cryptocurrency market saw a total of 32 investment and financing events, a 10.34% increase compared to the previous period, with a total funding amount of $150 million, a 27.18% decrease compared to the previous period:

In the DeFi sector, 9 investment and financing events were announced, including RWA company Securitize's successful completion of a $47 million strategic financing round, led by BlackRock; Ironlight also completed a $12 million financing round, with the majority of investments coming from individual investors with Wall Street backgrounds;

In the CeFi sector, 1 financing event was announced, with retail contract trading platform LazyBear announcing the completion of a $4 million USDT strategic financing, with participating investors and strategic partners including Gogeko Labs and DWF Labs;

In the GameFi sector, 6 investment and financing events were announced, including Swedish game studio Patriots Division raising $5 million for the Web3 game Shadow War;

In the infrastructure and tools sector, 5 investment and financing events were announced, including modular liquidity protocol Mitosis announcing the completion of a $7 million financing round, led by Amber Group and Foresight Ventures;

In the AI-related field, 1 investment and financing event was announced, with Web3 developer platform Airstack completing a $4 million seed round financing, led by Red Beard Ventures;

In other Web3/cryptocurrency application sectors, 7 financing events were announced, including Web3 content publishing platform Paragraph completing a $5 million financing round, with participation from USV and Coinbase Ventures.

From a period-to-period perspective, the number of cryptocurrency market investment and financing transactions increased slightly last week, but the total funding amount significantly decreased, with market enthusiasm focused on RWA, GameFi, and Web3 areas. In the VC sector, the noticeably active institutions this week were BlackRock and Electric Capital, mainly focusing on asset management and SocialFi fields.

According to Rootdata, the total financing amount in the cryptocurrency market in April was $1.025 billion, a 6.3% decrease compared to the $1.094 billion in March, with a 10.5% decrease in the number of financings. In terms of financing total amounts by sector, the top three sectors were CeFi, DeFi, and tools & information services.

About SecuritizeSecuritize is a digital asset securities company with a mission to provide shareholders with investment and trading opportunities in alternative investments, as well as to raise funds for companies, manage shareholders, and provide potential liquidity. Securitize has pioneered a fully digital integrated RWA platform for issuing, managing, and trading digital asset securities, compliant with the existing US regulatory framework, with a community of over 1.2 million investors and 3,000 companies.

About IronlightIronlight, founded by Rob McGrath and Matt Celebuski, aims to tokenize private securities such as real estate, natural resources, fine art, public infrastructure, and private equity, which typically lack liquidity, with the goal of becoming a regulated tokenized RWA market under the US SEC.

About KioskThe SocialFi project Kiosk is a Farcaster client that helps creators establish a community from 0 to 1 within the app. Creators can share media-rich ideas with the social graph, which can be minted as NFTs, gather like-minded collectors and collaborators in the channel, establish custom channel economies such as tips and distribution, and chat with their community — all within the Kiosk application.

2. Industry Data

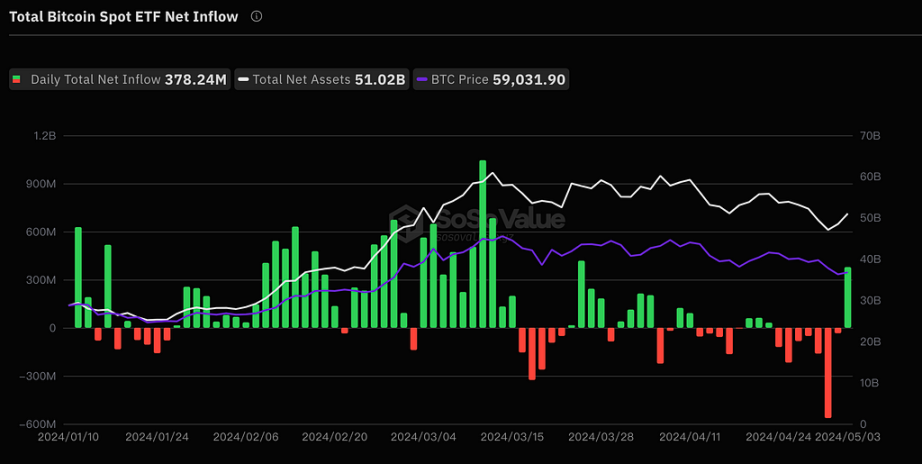

After 7 consecutive days of net outflows, US BTC spot ETF sees first net inflow

SoSoValue data: On May 3rd, Eastern Time, the total net inflow of BTC spot ETF in the US was $378 million, marking the first net inflow after 7 consecutive days of net outflows. Among them, Fidelity's FBTC had the highest single-day net inflow of $103 million, with FBTC's total historical net inflow reaching $8.03 billion.

After the listing of the US BTC spot ETF, its trend has been consistently correlated with market dynamics. With the positive net inflow of the ETF, the market trend has started to show a slight rebound in recent days. Additionally, the net inflow trend of the ETF is likely to strengthen in the following week, but the net inflow scale of GBTC is still not high, and the continued inflow scale may not be significant.

Currently, the net asset value of the BTC spot ETF is $51.021 billion, with an ETF net asset ratio (market value as a percentage of total Bitcoin market value) of 4.12%, and a total historical net inflow of $11.561 billion.

Hong Kong ETF asset management scale exceeds 2 billion Hong Kong dollars, but falls short of expectations

Official data from the Hong Kong Stock Exchange: As of the close of May 3rd, the three Hong Kong spot virtual asset ETFs of Huaxia, CSOP, and HashKey had a total asset management scale of 2.13069 billion Hong Kong dollars (approximately $255 million) in the first week of listing, nearly twice the asset management scale of virtual asset futures ETFs, which was about 1.192 billion Hong Kong dollars. Among them:

The total trading volume of the BTC spot ETF was $27.51 million, with a total holding of 4,220 BTC, and a total net asset of $250 million;

The total trading volume of the ETH spot ETF was $4.92 million, with a total holding of 16,280 ETFs, and a total net asset of $48.52 million.

This data shows a significant deviation from market expectations after the approval of the Hong Kong ETF, but compared to data from Canadian ETFs and UK ETNs, it appears relatively reasonable. We need to take a more rational view and evaluation of the market scale and influence of Hong Kong, and continue to pay attention to its policy dynamics.

Hong Kong Spot ETF Data: CSOP HashKey Bitcoin ETF has an asset management scale of 447.22 million Hong Kong dollars, and the Ethereum ETF has an asset management scale of 90.82 million Hong Kong dollars;CSOP Bitcoin ETF has an asset management scale of 449.39 million Hong Kong dollars, and the Ethereum ETF has an asset management scale of 89.87 million Hong Kong dollars;Huaxia Bitcoin ETF has an asset management scale of 904.49 million Hong Kong dollars, and the Ethereum ETF has an asset management scale of 148.9 million Hong Kong dollars, totaling over 1 billion Hong Kong dollars;

Hong Kong Futures ETF Data: Samsung BTC Futures ETF has an asset management scale of approximately 135.12 million Hong Kong dollars;Southern Dongying Bitcoin ETF is approximately 848.9 million Hong Kong dollars;Southern Dongying Ethereum ETF is approximately 208.06 million Hong Kong dollars;

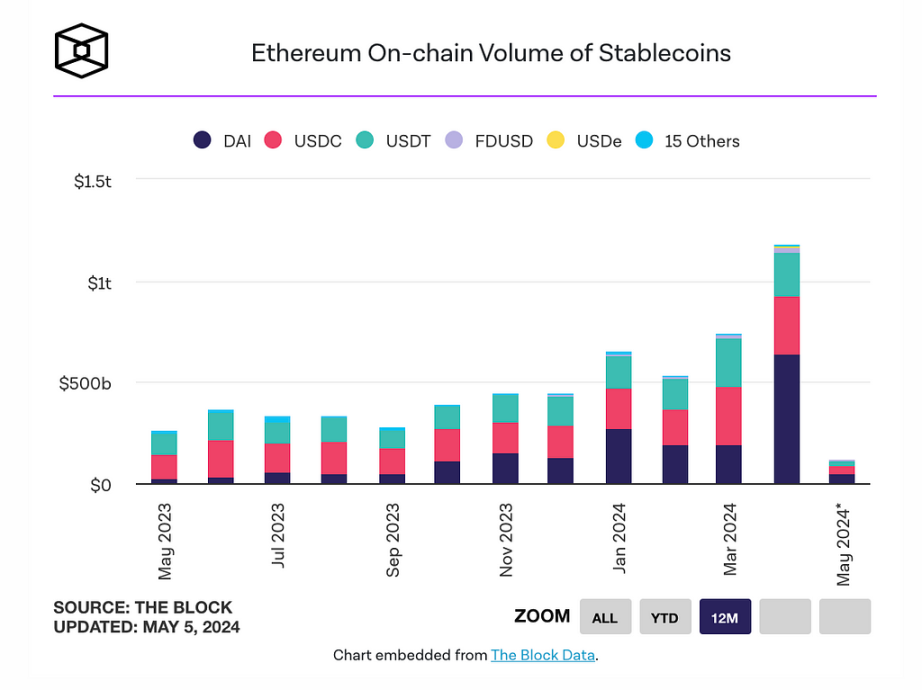

ETH Stablecoin Trading Volume Breaks Monthly Record

According to The Block, over the past 3 months, the monthly trading volume of stablecoins on ETH has continued to grow, reaching a new monthly trading volume high in April. FDUSD in particular set a new monthly record.

In fact, much of this data contribution comes from the use of DAI in MEV transactions, where a large amount of DAI is minted and returned in a single transaction, significantly boosting the trading volume data for DAI. Even excluding flash loans, stablecoin trading volume still performed well, indirectly indicating the steady rise in the activity of ETH ecosystem applications.

Regarding DAI's trading data:According to The Block's data, DAI's trading volume in April reached a high of $636 billion, accounting for a major portion of the total on-chain trading volume of Ethereum stablecoins, with a total trading volume close to $1.2 trillion for the month. Compared to March, DAI's trading volume more than tripled in April.At the same time, DAI's supply has increased by approximately $1 billion since March 7, bringing the current total supply to 5.44 billion. Although the trading volume of other stablecoins has also increased, DAI's share in the total stablecoin supply has slightly increased during this period.

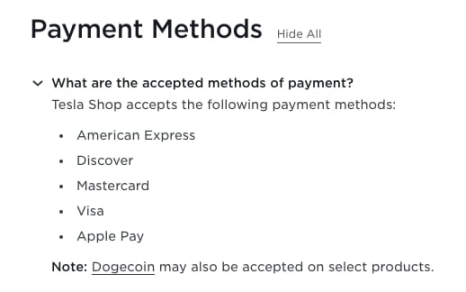

Tesla Adds DOGE Payment, DOGE Surges Over 20%

Information from Tesla's website: Some of its products support payment with Dogecoin, and such products will display the Dogecoin symbol next to the order button. Buyers only need to transfer Dogecoin to Tesla's Dogecoin wallet and make the payment. Following this news, according to CoinGecko data, DOGE surged over 20%, breaking the $0.168 level and currently trading at $0.162.

While Tesla's preparation for accepting Dogecoin payments has been ongoing for some time, its implementation still represents further integration between the cryptocurrency industry and traditional markets. Through Tesla's global influence, more people are beginning to perceive and engage with crypto assets.

According to Wayback Machine, the last snapshot of the "Payment, Checkout, and Pricing" page on the Tesla official website was on February 28 of this year, while the Dogecoin FAQ page has been in existence since January 2022.

In addition, the Tesla official website currently supports the purchase of goods with Dogecoin, but these goods do not include Tesla cars and mainly consist of small peripheral products such as clothing, toys, children's electric four-wheelers, hats, stainless steel whistles, and commemorative belt buckles, and these products are not sold through official channels in China.

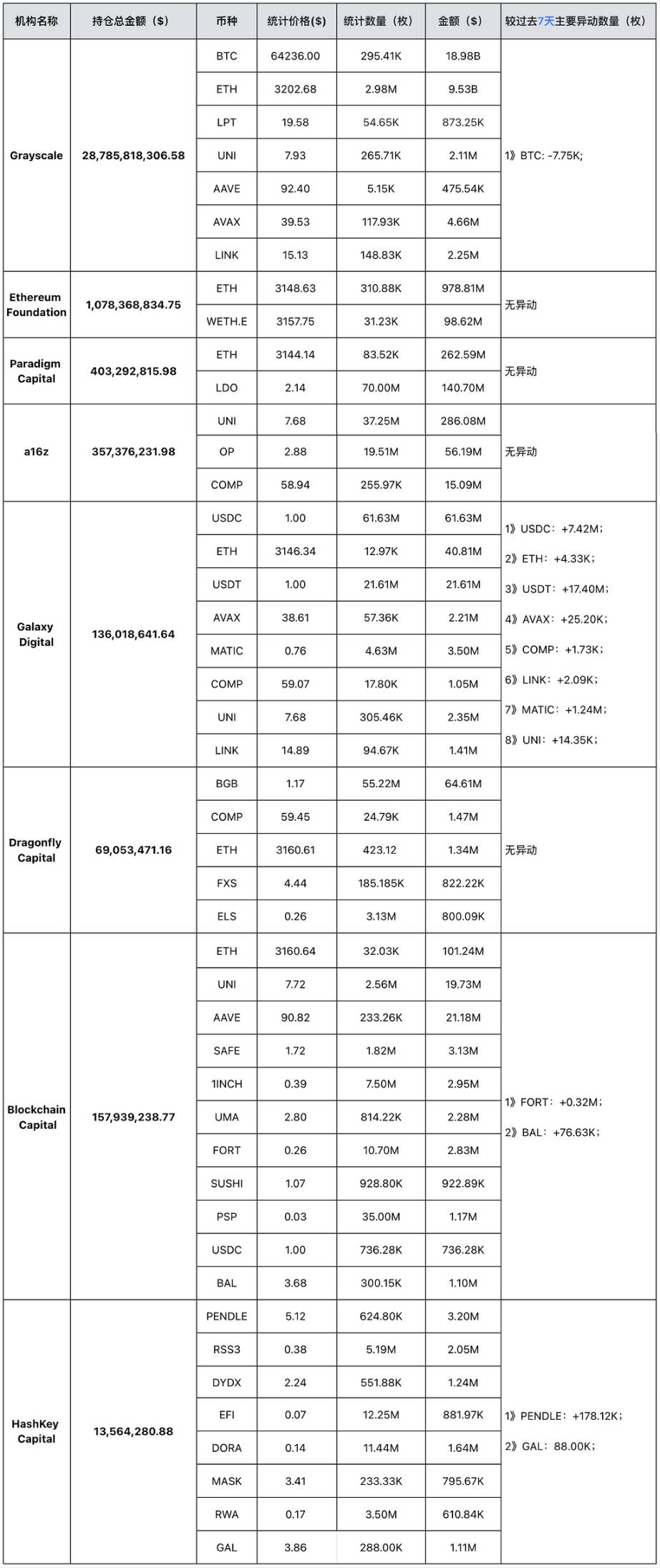

3. VC Holdings

Note: The above data is from https://platform.arkhamintelligence.com/, as of May 6, 2024, 18:00 (UTC+8).

4. Focus of the Week

May 7th

FOMC voter and Richmond Fed President Barkin speaks on economic outlook;

FOMC permanent voter and New York Fed President Williams speaks;

L2 network Mode, built on OP Stack, launches governance token MODE with a total supply of 10 billion;

Hackathon submission phase hosted by TRON in collaboration with HTX DAO, BitTorrent Chain, and JustLend DAO continues until May 7th;

Bitcoin Devcon hosted by UTXO Management takes place in Hong Kong from May 7th to 8th;

May 8th

US EIA crude oil inventory data for the week;

Speech by Federal Reserve Vice Chair Jefferson on the economy;

FT Crypto & Digital Assets Summit;

May 9th

US initial jobless claims for the week;

Bank of England interest rate decision announcement;

Bitcoin Summit (Bitcoin Asia) takes place in Hong Kong from May 9th to 10th;

May 10th

US one-year inflation rate expectations;

University of Michigan Consumer Sentiment Index;

Speech by Federal Reserve Governor Bauman on financial stability risks;

EigenLayer plans to start token distribution on May 10th, issuing 5% of the total token supply based on the snapshot from March 15, 2024;

Biconomy airdrops ARB to BICO stakers, with the deadline for claiming ending on this day;

Kraken will delist privacy coin Monero (XMR) from the Ireland and Belgium markets and stop accepting deposits from May 10th;

May 11th

Speech by Federal Reserve Governor Barr;

China's April CPI year-on-year rate announcement;

Moonbeam (GLMR) will unlock approximately 3.04 million tokens, worth about $920,000, accounting for 0.35% of the circulating supply;

May 12th

Decentralized GPU cloud infrastructure Aethir's Aethir Cloud Drop airdrop event continues until May 12th;

Jupiter LFG Launchpad's second phase project UpRock plans to start reputation proof and TGE events on May 12th;

5. Conclusion

Last week, although the cryptocurrency market experienced local fluctuations, the increase in investment and financing activities indicates the vitality and long-term growth potential within the industry, especially with increased investor attention on RWA, GameFi, and Web3 areas, potentially making these areas new market growth points. Additionally, the performance of BTC and ETH ETFs, as well as Tesla's support for DOGE payments, all indicate that crypto assets are increasingly being perceived and accepted in broader financial and consumer markets.

This week, the release of US EIA crude oil inventory data and one-year inflation rate expectations, the Bank of England interest rate decision, and the announcement of China's CPI year-on-year data are likely to have a significant impact on the subsequent market trends. As the Fed slows down the pace of balance sheet reduction, although inflation concerns persist, the improvement in market liquidity will gradually become apparent. If no extreme negative events occur, the entire market is expected to enter a phase of valuation recovery.

The current market still faces many uncertainties, but in the long run, with the improvement in macroeconomic conditions and increasing mainstream market acceptance, the potential of the cryptocurrency market will be further unleashed, ushering in a new round of market trends.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。