交易理念:大周期看趋势,小周期找点位;

消息面:明日凌晨2点美联储将公布新一轮的利率决议,预期指5.5%,前值5.5%,如公布值高于预期值5.5%则利空,也就是加息,低于预期则利好,也就是降息,依照前几次公布情况看,本次大概率还是符合预期的,因此不要对降息抱有太大幻想,至于鲍威尔讲话,还需理性看待,除非有明确的鸽派言论,才能引发币价的趋势逆转,正常情况只是短暂上下插针洗盘而已!

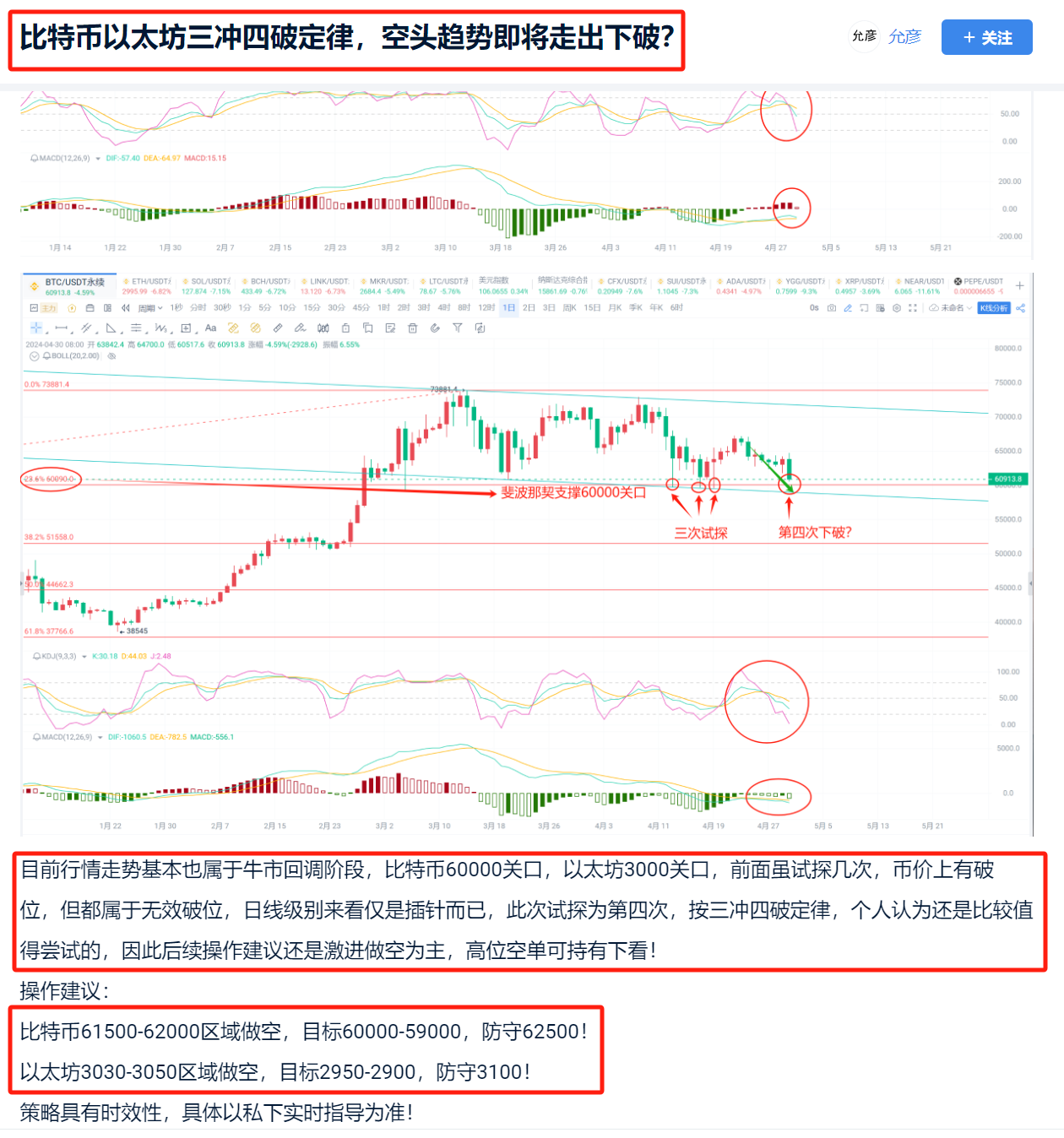

技术分析:比特币方面,本月月线收大阴K,基本将3月份涨幅全部收回,MACD均线有低头迹象,多头量能开始缩量,KDJ线向下运行,且按斐波那契来看,78.6%(61300附近)失守,行情很可能会下探61.8%(51500附近),日线级别已将布林带下轨跌破,MACD均线及KDJ线均向下运行,空头量能继续放量,以太坊方面,月线级别收大阴K,跌破03月涨幅,斐波那契61.8%(3350附近)未能守住,破位即跌至斐波那契50%(2875附近),这一线如再破位,便会来到38.2%(2400一线),日线级别技术指标基本与比特币同步;

综上来看,目前行情走势基本符合前几日空头预期,昨日也明确提出过“三冲四破”的定律,比特币60000,以太坊3000一线前期试探三次,第四次再试探大概率会走出破位行情,因此布局的空单成功验证思路,拿下比特币近4000点,以太坊近200点完美止盈离场,具体可查看前面文章!后续预计行情会反弹确认压力位,后再延续空头趋势,稳健待反弹后依托压力位附近做空,激进则可轻仓做多看一波反弹修复!

操作建议:

比特币:56700-57200做多,目标58300-59000!58800-59300做空,目标58000-57000!

以太坊:2820-2850做多,目标2920-2950!2930-2960做空,目标2850-2800!

策略具有时效性,具体以私下实时指导为准!

关注微信公众号允彦!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。