Daily Sharing

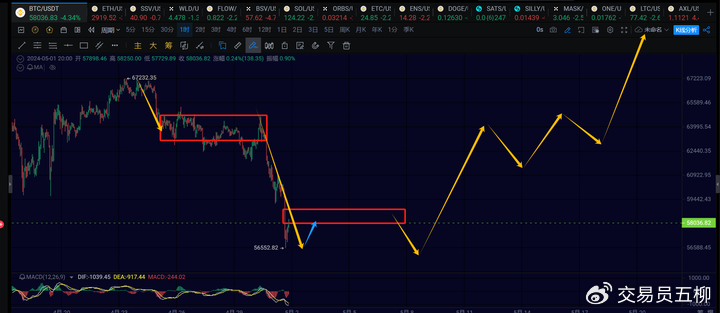

During the May Day holiday, the market experienced a downturn. The price of Bitcoin dropped from around 60000 to 56552, and it has now entered the lower range of our expected target area. In the short term, there is some support at this level, but the market structure of Bitcoin and Ethereum has not fully developed. Therefore, it is advisable to wait for the structure to complete before considering a medium-term long position. Patience is required, and the daily downtrend has almost reached its end.

In the next few days, it is highly likely that there will be another retracement in the short term, and the market is expected to transition from a downtrend to a consolidation phase. It is anticipated to consolidate at the lower level for a few days before starting to rebound. Overall, the opportunity for bottom fishing is approaching, so be prepared at all times.

BTC

Due to the rapid changes in the market, the analysis can only provide a prediction based on the market conditions at the time of publication. Short-term traders should pay attention to the latest market changes and use the analysis as a reference only.

1H:

On the 1-hour chart, the current structure is a downtrend followed by a consolidation and another downtrend. The left side of the chart has already completed this structure, and the current movement is a continuation of the downtrend from the consolidation phase. It is expected to retrace to around 56200 before another rebound. Subsequently, a rebound in the range of 57500 to 60000 is likely, forming a 1-hour consolidation, before retracing to around 56000 to conclude the daily downtrend and start a new uptrend at the daily level.

Of course, this is a personal expectation. The actual market structure is still waiting for the completion of the current 1-hour downtrend from 64734, followed by a rebound and another downtrend at the 1-hour level. The strength of the next 1-hour downtrend will determine whether the 4-hour downtrend has ended, and further judgment is needed to determine if the daily level rebound has ended.

15M:

At the 15-minute level, there is currently a rebound in progress, with an expected target near 59000 to 60000. It is anticipated that there will be another 15-minute downtrend to conclude this 1-hour retracement, followed by another 1-hour rebound. According to the analysis from the previous night, if the next 1-hour rebound fails to break through 63400, there will be another 1-hour downtrend, retracing to the previous low.

ETH

There is a probability that Ethereum will start a 1-hour rebound, with potential targets near 3030 or 3070. Subsequently, there may be a third 1-hour downtrend, likely retracing to around 2750 to 2800. After this retracement, it is possible that the 4-hour or daily downtrend will conclude.

At the 15-minute level, if Ethereum retests near 2980 in the short term, there is a chance of a 1-hour rebound, as indicated by the white arrow in the chart. If it does not break through 2980, there may be another 15-minute retracement to around 2800 to conclude the 1-hour downtrend.

Trend Direction

Weekly Level: Upward direction, currently a continuation of the weekly rebound from 15476. Pay attention to the subsequent daily trend to determine when it will end.

Daily Level: Downward direction, has reached support near 56000. Observing the completion of the subsequent structure.

4-hour Level: Downward direction, the 4-hour downtrend is ongoing and has not ended. At least one more 1-hour rebound and 1-hour downtrend are expected.

1-hour Level: Upward direction, the end of the 1-hour downtrend is approaching. If there is another 15-minute downtrend, it should be close to the end. Then, observe whether the next 1-hour rebound can break through 60500.

15-minute Level: Downward direction, there should be another 15-minute downtrend to retest the 56000 to 55000 range.

Feel free to follow my public account for further discussion and exchange:

This article is time-sensitive. Please be aware of the risks. The above is only personal advice and is for reference only!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。