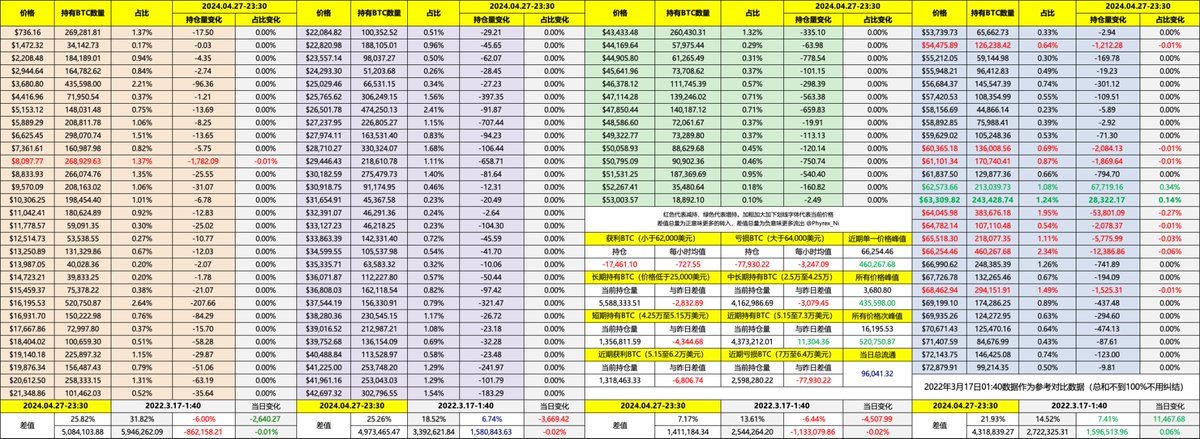

周末的数据就别太指望有什么出彩的地方,这也是实际上已经发生的情况,现在的数据已经越来越像熊市靠拢了,根本原因就是我们说过的,现在 #BTC 的价格在60,000美元到70,000美元之间的波动几乎都不会引起投资者的兴趣,包括获利投资者和亏损者都是一样,昨天我们也从成交量上看了,目前的成交量甚至不如去年年底。

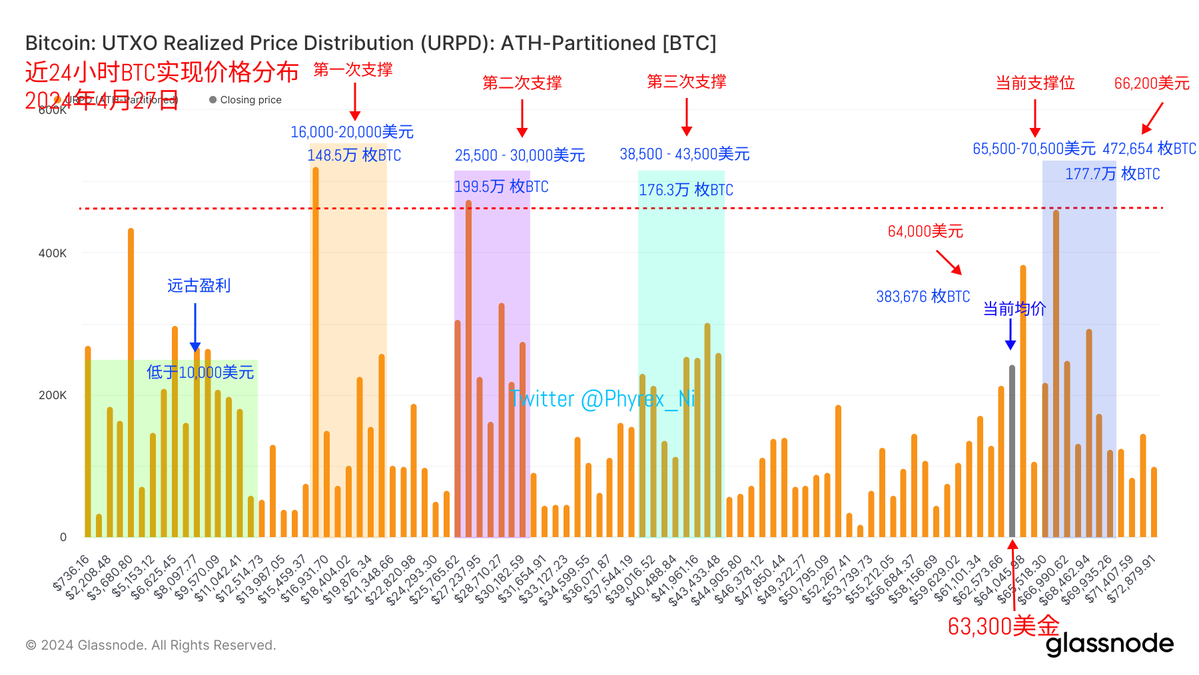

不过下周这个情况可能会发生改变,下周二凌晨美股闭盘后是 @MicroStrategy 发布财报的日期,上次在2月底的时候其实BTC的价格走势和现在也很像,流动性很低,振幅很差,甚至单一价格的存量超过了120万枚,然后在 $MSTR 财报的刺激下直接冲上了73,000美元,这一次不知道会不会重现。

而且除了MSTR以外,下周五凌晨美股闭盘的时候是 @Coinbase 发布财报的日期,尤其是本次的 $Coin 财报是包括了第一季度 #Bitcoin 现货ETF 收益的,如果市场反映的不错的话,MSTR和Coin都有拉盘的可能,所以先不说BTC,我个人是打算周一开始抄短线买点MSTR,然后Sell the News ,周四在去买点Coin,看看能不能赚点小钱。

回到BTC本身的数据来看,流动性的下降必然是更是的BTC参与到换手中,这也没什么可说的,从目前的支撑数据来看,65,000美元一带仍然是近期最大筹码的堆积带,这部分的投资者仍然没有大量要离场的迹象,而较早期投资者也是一样,愿意动的筹码几乎寥寥无几,周末的流动性就是这么回事,用周末的价格来衡量接下来的涨跌儿戏了一点。

交易所的 #BTC 存量仍然不温不火,周五晚上看到较多的抛压果然还是在凌晨2点以后被消耗的差不多的了,虽然并没有刷新近六年的最低存量,但差距并不是很大,也就是不足3,000枚BTC左右。

这也代表了多数投资者的情绪和我们预料中的一样,交易所越来越少的筹码说明更多的投资者并不急于卖出,虽然购买力还是较少,但买入的BTC基本都被提到了用户的钱包中,交易所的存量也是每周都能有数次刷新近六年的最低存量。

数据已更新,地址:https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

本推文由 @ApeXProtocolCN 赞助|Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。