撰文:2Lambroz

编译:深潮TechFlow

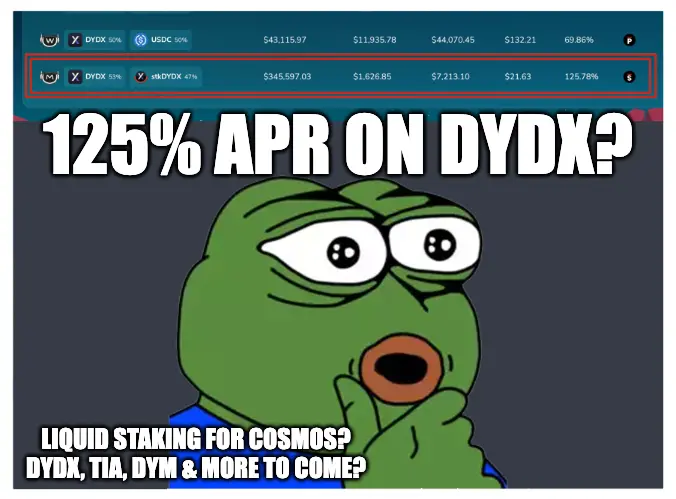

在dYdX上赚取 141% 的收益!

或者通过在永续合约上对冲赚钱125%收益 + 12% delta 中性流动性质押赚取 $DYDX

探索 Cosmos 上 LSD 收益的分步指南

随着DYDX应用链、$TIA和$DYM获得更多关注,为什么不了解更多关于Cosmos流动性质押的信息?

摘要

pSTAKE Finance是一个专注于cosmo资产的流动性质押协议。

我 一直在探索,因为 DYDX 应用链,$TIA和$DYM更多的关注来到了 Cosmos,我发现了一些很好的收益模式!

我将一步步介绍如何在pSTAKE Finance上获得dydx、stkdydx 上125%的收益。

什么是Persistence和流动性质押

Persistence 是 Cosmos 的流动质押协议。

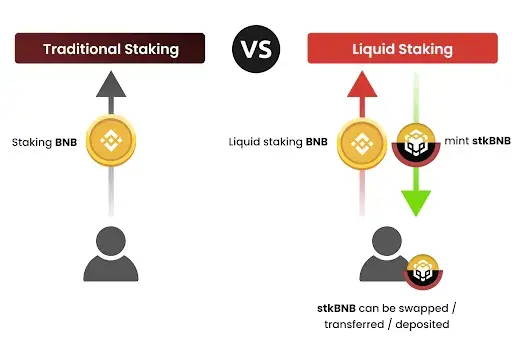

流动质押是将质押资产的头寸代币化,让用户在赚取收益的同时保持流动性。

例如,如果您要质押 $DYDX ,您将必须等待 30 天才能取消质押并赎回您的头寸。

但如果您通过持久性进行质押,您质押的 DYDX 头寸将是 stkDYDX,即该质押头寸的代币化头寸。

简单来说,就是在保持流动性的同时赚取质押收益。

这能够使得:

无需等待30天即可退出质押仓位,直接出售您的stkDYDX

提供LP并赚取DYDX/stkDYDX交易费

如果stkDYDX有折扣(不是与dydx 1:1),你可以购买stkDYDX并取消质押30天,赚取差价

Persistence有一系列流动质押选项,但我重点关注 $DYDX ,因为它的收益率目前是最好的。

Persistance 是 Pstake Finance 和Dexter的母公司,它是质押资产的 dex。

策略描述

将你DYDX 的 1/2 质押到 stkDYDX

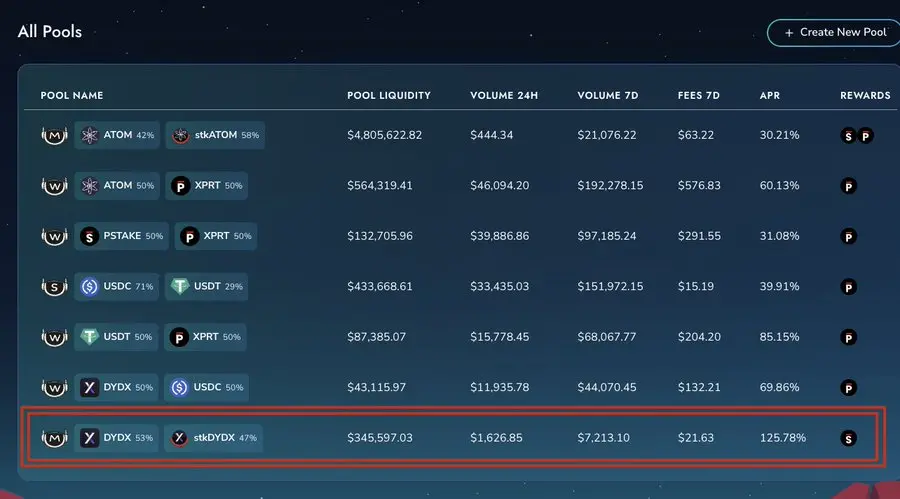

在Dexter上提供LP即可赚取125%的年利率

可选的:在 CEX 上做空 dydx 以获得额外 12% 的年利率并保持 Delta 中性

下面是详细的步骤:

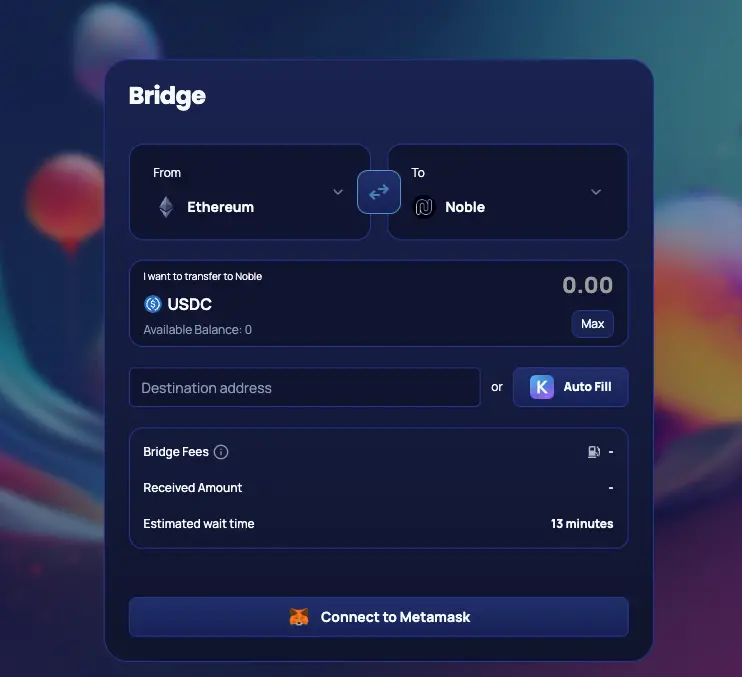

1.如果您只有EVM上的资产,您可以使用@CCTPMoney将资金转移到Cosmo链,路线必须是 EVM -> Noble -> Persistence

如果没有,您可以使用 CEX 将资金发送到 XPRT,然后在Dexter中交换到 DYDX

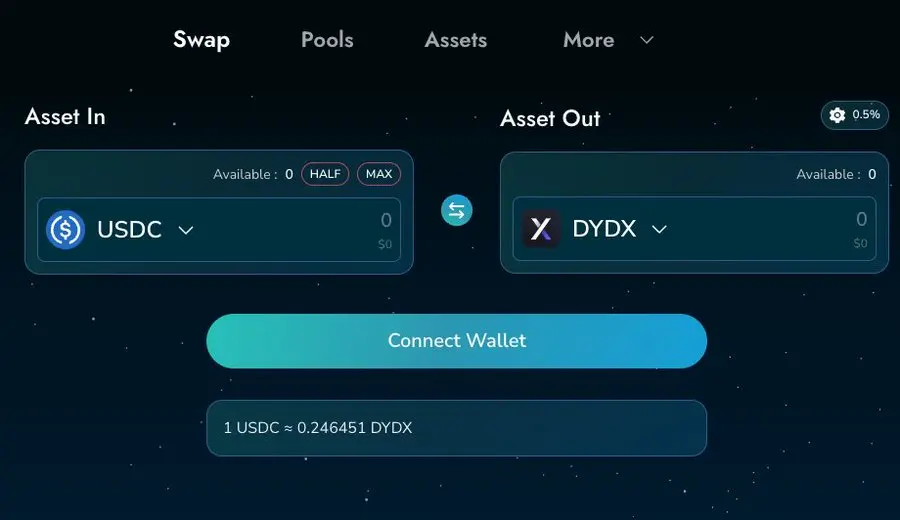

2.如果您使用 CCTP 资金,您现在持有 USDC,在Dexter上购买 DYDX,点击这里进入网站。

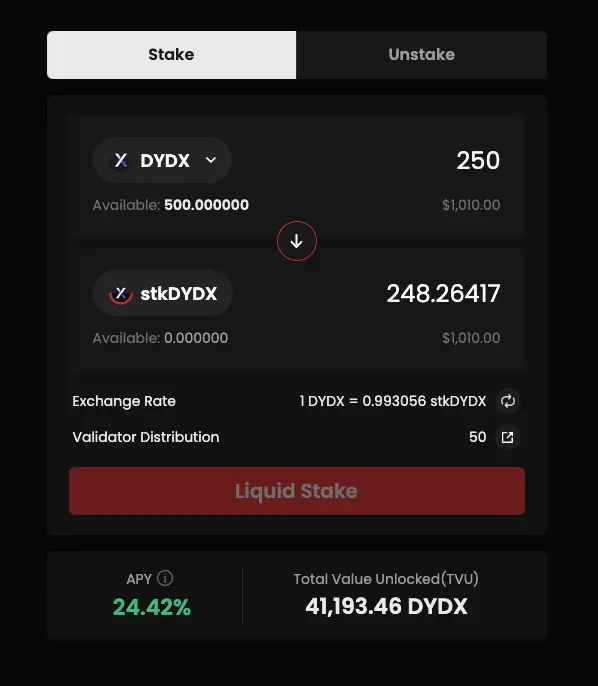

3.将你DYDX 的一半流动质押到 stkDYDX

4. 在 Dexter 和 bond 上添加流动性 7 天即可赚取 141% 年利率

绑定意味着您需要锁定仓位7天才能获得额外的排放$xprt收益率(年利率125.78%)

如果您担心 DYDX 的价格可能会下跌怎么办?

对冲它!也称为 Delta 中性策略。

假设我在 LP 中有 250 DYDX 和 250 stkDYDX,这意味着我有 500 DYDX 价格敞口。

所以如果我也在 CEX 上做空 500 DYDX,这意味着我的 DYDX 价格敞口为 0,因为我同时持有 500 DYDX 并做空 500 DYDX!

实际上因为资金利率一直是正数,您的空头头寸也将获得支付补贴(如果资金费率保持不变)。

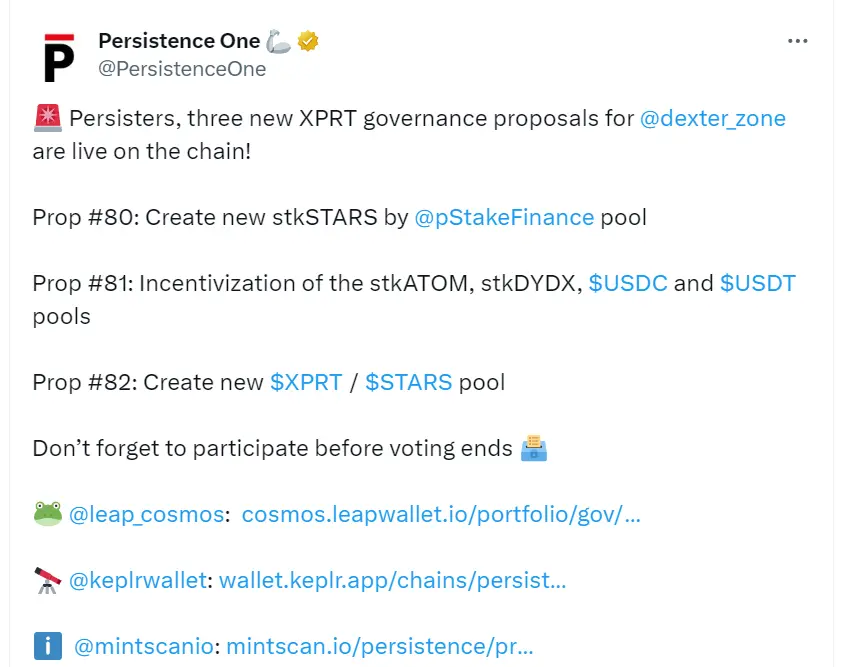

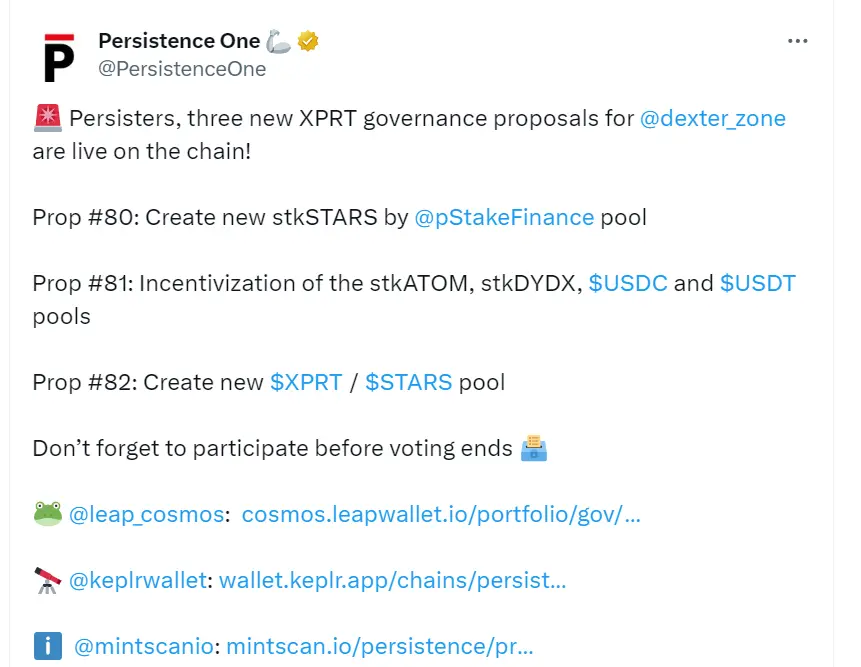

同样有趣的是,来自@StargazeZone的cosmo NFT链(badkids NFT所在的链)的$STARS被提议列为流动质押资产之一,可能会带来一些收益。

总结

如果你已经持有的话,DYDX上的流动性质押收益不错

可以进行delta中性挖矿

不妨去多多了解LST

关注persistence生态系统总是好的,最近 cosmos SDK资产很受关注,$TIA $DYM等等

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。