晨间行情可能会如何走?小A为您解析!

欢迎来群聊问小A,获取更多分析:https://jv.mp/JaQ0CE

BTC

BTC的1小时价格趋势:横盘。

这是一张 1小时 Binance BTC/USDT的K线图,最新价为:66126.0 USDT,包含了EMA、 MACD、KDJ和成交量指标。

【买卖点位】

-

买入点一:66500 USDT(考虑到EMA(7)和EMA(30)仍然保持上涨趋势,且价格在此水平有支撑表现)

-

买入点二:65500 USDT(近期低点附近,若市场再次测试该区域可能会出现买盘介入)

-

做多止损点:64800 USDT(留有足够空间以避免小幅波动触发止损,同时低于03月06日的大阴线低点)

-

卖出点一:67500 USDT(接近最新价的高点,可作为短期卖出目标)

-

卖出点二:68500 USDT(近期内的较高点,若价格能突破则可能进一步看涨)

-

做空止损点:69000 USDT(超过最近几天的最高点,为做空提供安全垫)

【价格趋势分析】

-

K线形态:

- 近期出现了从03月06日03:00的大阴线到03月06日05:00的反弹,显示市场在经历急剧下跌后有买盘介入。

- 03月07日02:00至最新价之间K线波动较小,实体长度不一,但未见明显的特定K线组合。

-

技术指标:

- MACD指标:DIF和DEA均处于正值区域,但MACD柱状图已由正转负,表明多头势力减弱,可能进入调整期。

- KDJ指标:J值在最新数据中低于K值和D值,且三者都在50以上,暗示短期内可能存在回调压力。

- EMA指标:EMA(7)始终高于EMA(30),说明短期趋势仍然偏向上涨,但差距正在缩小,需注意是否会发生交叉。

-

成交量:

- 从03月06日03:00开始成交量激增,伴随价格大幅下挫,显示卖方力量强劲。

- 最近几个小时成交量相对稳定,没有异常放量情况,市场参与度保持一致。

ETH

ETH的1小时价格趋势:跌。

这是一张 1小时 Binance ETH/USDT的K线图,最新价为:3818.53 USDT,包含了EMA、 MACD、KDJ和成交量指标。

【买卖点位】

-

买入点一:3650 USDT(此价格附近为03月06日11:00至12:00的支撑区域,且EMA(30)在此附近提供额外支持)

-

买入点二:3500 USDT(此价格是03月06日05:00至06:00期间的低点,市场可能会对这个心理价位产生支撑反应)

-

做多止损点:3400 USDT(留有足够空间以避免小幅波动触发止损,同时考虑到3205是最近周期内的最低点,给予适当下探空间)

-

卖出点一:3800 USDT(接近当前K线的开盘价,并且是一个短期阻力位,之前的高点也在这个水平附近)

-

卖出点二:3900 USDT(靠近最近周期内的最高价3906.42,可以作为短期内的目标卖出价位)

-

做空止损点:3950 USDT(超过最近周期内的最高点,为做空操作提供保护,确保如果行情向不利方向发展时能及时退出)

【价格趋势分析】

-

K线形态:

- 近期K线显示价格波动较大,03月06日02:00至03月07日07:00间出现了明显的下跌趋势,最低点达到3205,随后有所反弹。

- 03月06日19:00至20:00和03月07日00:00至01:00两个时间段内出现长上影线,表明高位卖压较重。

-

技术指标:

- MACD指标中DIF在DEA之上但二者差距缩小,MACD柱状图由正转负,暗示可能的下行趋势。

- KDJ指标J值从高位回落,K与D线交叉向下,提示近期存在回调风险。

- EMA(7)在EMA(30)之上,但差距逐渐减少,若EMA(7)穿过EMA(30)可能会产生死叉信号。

-

成交量:

- 在价格大幅下跌时成交量放大,如03月06日03:00的大阴线伴随着巨量成交,这通常是下跌确认的信号。

- 随后成交量开始逐步减少,表明市场恐慌情绪有所缓解。

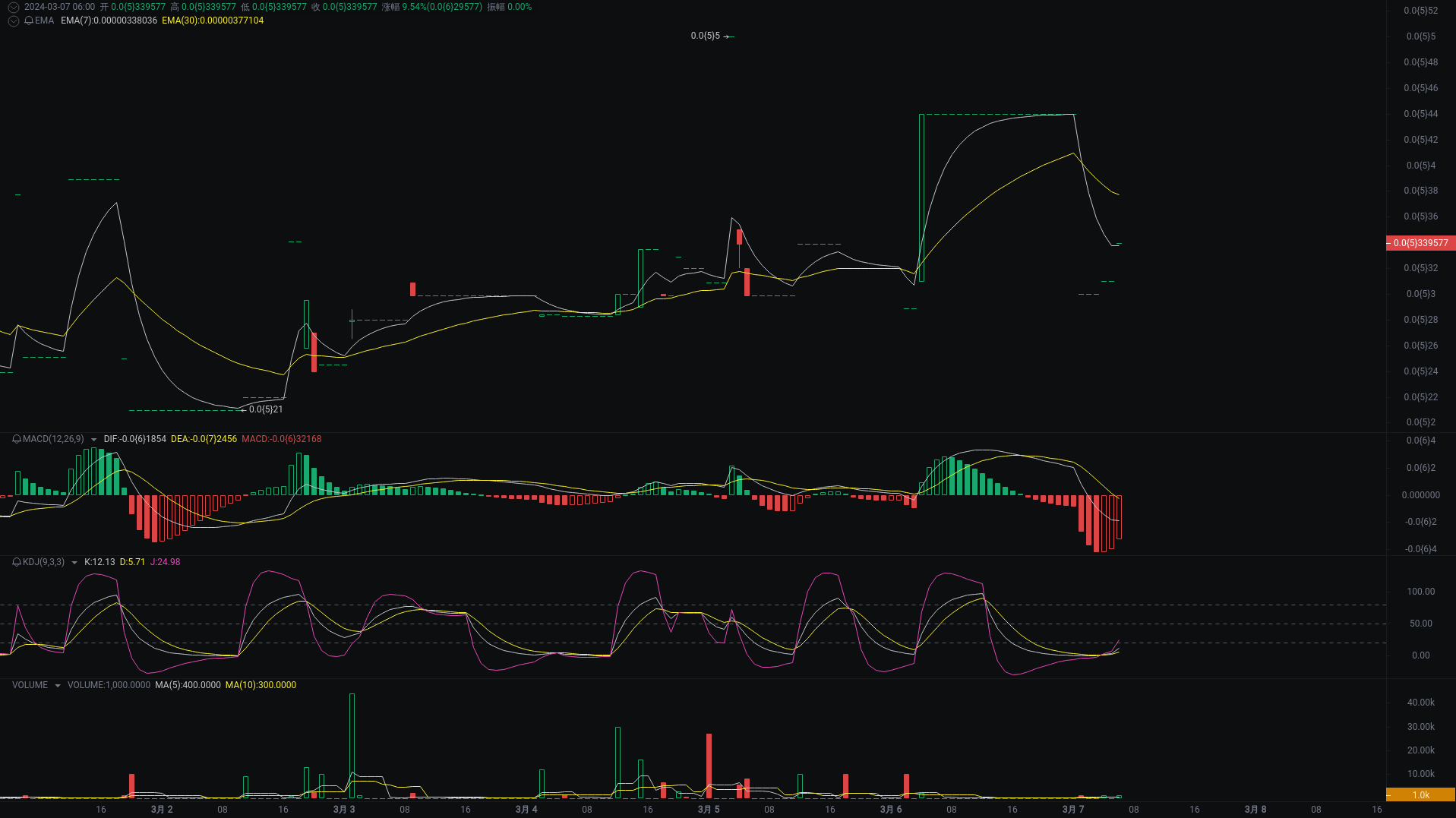

pepe

pepe的1小时价格趋势:跌。

这是一张 1小时 OKX Ordinals pepe/BTC的K线图,最新价为:0.00000339577 BTC,包含了EMA、 MACD、KDJ和成交量指标。

【买卖点位】

-

买入点一:0.00000310000 BTC(考虑到EMA(7)低于EMA(30),但MACD显示下跌动能减弱,若价格回调至此水平可能是短期内的支撑位)

-

买入点二:0.00000299000 BTC(这是近期的一个较低点,如果价格进一步下探到这个水平,可能会吸引买家介入,形成潜在的反弹机会)

-

做多止损点:0.00000289000 BTC(略低于买入点二,提供足够空间以避免小幅波动触发止损,并且该价位为最近周期内的最低点)

-

卖出点一:0.00000339577 BTC(当前市场价格,如果价格上涨并突破此点,可能表明短期内上行势头增强)

-

卖出点二:0.00000440000 BTC(近期高点,连续多个时段都有开盘和收盘,如果价格能再次达到此水平,可能会遇到卖压导致价格回落)

-

做空止损点:0.00000450000 BTC(高于卖出点二,给予做空操作足够的缓冲区域,同时也是心理关键阻力位)

【价格趋势分析】

-

K线形态:

- 从最近的价格动作来看,存在一定程度的波动。特别是在03月06日04:00时段,出现了较大幅度的价格变化,开盘价和收盘价均为0.00000310000,但最高价触及0.00000440000,这可能表明有强烈的买方参与并推高价格,但随后卖方介入导致价格回落。

- 在03月05日17:00至03月06日06:00期间,K线连续多个周期都以0.00000440000的价格开盘和收盘,没有上下影线,显示市场处于一种平衡状态。

-

技术指标:

- MACD指标显示,在03月07日06:00时段MACD值为负且DIF低于DEA,暗示当前趋势偏向下行。然而,需要注意的是MACD柱体正在减小,这可能预示着下跌动能减弱。

- KDJ指标中,J值在不同时间段内出现极端值(如超过80或低于20),这通常代表潜在的转折点。例如,在03月06日12:00 J值达到112.27,之后价格开始下降。

- EMA指标显示,7周期EMA在最新数据点位于0.00000338036,30周期EMA位于0.00000377104,短期EMA低于长期EMA,这通常被视为一个下跌趋势的信号。

-

成交量:

- 成交量在03月06日02:00达到峰值,此后成交量急剧下降,并在接下来的几个小时内保持较低水平,这可能意味着市场活跃度下降,缺乏足够的买卖力量来支撑价格走势。

- 在价格大幅波动的时段(如03月06日04:00)成交量也显著增加,这表明价格波动与成交量的放大有关联。

※全部内容由智能分析助手小A提供,所有内容仅供参考,不构成任何投资建议!

小A智能分析系 AICoin 行业首推的智能分析工具,轻松帮你解读币种走势、分析指标信号及识别进离场点位等,前往APP或PC端即可体验。

PC端下载:https://www.aicoin.com/zh-CN/download

APP下载:https://www.aicoin.com/download

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。