撰文:@yelsanwong

指导老师:@CryptoScott_ETH

TL;DR

-

Orion 通过流动性聚合、虚拟订单簿,同时集成了高安全性的跨链桥将分散的 DEXs 与 CEXs 流动性整合到单一访问点,大幅简化了用户的交易流程,带来了无缝的用户体验。

-

近期,Orion 推出的 Refer&Earn 活动鼓励有影响力的人物和协议忠实用户推荐新用户加入,并提供相应 $ORN 和交易手续费减免作为激励,这种基于奖励的推荐机制不仅能快速增加平台的用户基数,还能通过社区成员的自然社交网络扩散 Orion 的品牌,实现有机增长。

-

Orion 于近期推出了 BRC20 跨链桥,这极大地扩展了 Orion 协议的功能,使其得以在比特币网络上支持代币的创建和交换,为比特币金融(BTCFi)生态系统的扩展奠定了关键基础。这一进展不仅丰富了比特币的应用场景和价值,也为 Orion 提供了将 BTCFi 与更广泛的去中心化金融(DeFi)生态系统相连接的独特机遇。考虑到去年比特币生态的迅速扩张,我们预计 BTCFi 将成为一个高速增长领域,而 Orion 通过其跨链桥解决方案,有望在这一领域实现显著增长。

1.项目简介

Orion Protocol 成立于 2018 年,最初的设计目的是为了提供一个统一的、去中心化的交易解决方案,通过流动性聚合器连接到所有主要的加密货币中心化交易所(CEXs)和去中心化交易所(DEXs),允许用户能够在其去中心化平台上访问整个市场的流动性,以获得任何代币在市场上的最优价格。

Orion Protocol 同时通过集成高安全性的跨链桥、虚拟订单簿,旨在提高交易效率、降低成本并提供无缝的用户体验。该平台核心在于其整合分散的市场流动性到单一访问点,从而简化了用户的交易流程,同时保持 Defi 高透明度、高安全性和不依赖中介等特点。

2023 年 11 月,Orion Protocol 宣布将 ‘Orion Protocol’ rebrand 为 ‘Orion’, 以此重振协议并提供更清晰更有针对性的价值主张,同时扩大 ORN 代币的效用和潜力。

2.项目背景

2.1 团队背景

Alexey Koloskov ( 创始人 & CEO)

Alexey 在担任 Orion Protocol 首席执行官前是 Waves 的首席架构师,在此期间,他成功领导了 Waves 去中心化交易所的架构设计与开发工作,自 2017 年 6 月起,Alexey 作为 Orion Protocol 的创始人兼首席执行官,已经领导该项目超过 6 年,期间负责制定公司战略、监督产品开发,并推动 Orion Protocol 在区块链行业中的创新和增长。

Kal Ali ( 联合创始人 & COO)

作为 Orion Protocol 早期战略顾问和联合创始人的 Kal Ali 目前同时兼任 Dominance Ventures 有限合伙人,该风投机构曾参与 Cosmos, Gunzilla Games, Avalanche 等项目的早期投资。

2.2 融资情况

3.产品及业务

3.1 Orion Terminal

Orion Terminal, 作为 Orion Protocol 的核心产品,通过其独特的流动性聚合机制实时访问并整合多个交易所的订单簿。该机制覆盖了包括中心化和去中心化平台在内的广泛交易所,确保用户可以在单一界面中获得全市场最优的交易价格和深度。

这一创新不仅为用户提供了优化的交易执行和定价策略,还有效降低了交易成本,提升了市场的整体效率。以下为该机制的实现路径。

3.1.1 deCEX Trading:以去中心化的方式使用 CEXs

通过 Orion Terminal,用户无需在中心化交易所中创建个人账号,免去了个人 KYC 等繁琐程序。通过 Orion 在 CEX 中建立的账户,又称流动性节点或流动性供应商,用户发起交易时会通过原子交易(通过智能合约一步完成交易的所有环节,确保交易要么完全成功,要么完全不发生,不存在中间状态)发送给流动性节点,并由节点在 CEX 上执行该交易,随后立刻收到代币。与传统 DEX 使用 AMM 机制不同,deCEX 提供实时的订单簿,提供了更为精准和即时的交易数据。

安全偏差机制(SD):

虽说原子交易或许对于用户来说可以保证在资金安全的前提下以理想价格发送交易请求,Orion 又如何确保用户能以最佳价格完成交易?对此,Orion 对交易设置了安全偏差 SD (Safe Deviation)。

简单理解,SD 即是一个自动化预设的交易滑点,在 CEX 中 USDT 交易对中由于大多数交易对流动性充足,因此 SD 为 0;CEX 的非 USDT 交易对中(如 ETH/BTC)应用 0.4% 的 SD;DEX 中单笔 swap 应用 0.15% 的 SD,涉及到多步骤 swap 则将 0.15% 乘以对应步骤数量。在此过程中 Orion 不收取除根据订单量计算的实际佣金和网络费用之外的附加费用。

与用户自己设置滑点不同的是,尽管 SD 和用户设置的滑点都影响交易价格,但 SD 作为一个固定的、预先定义好的机制,为用户提供了一定程度的透明度和价格变动的可预测性。

即便是在极端市场条件下,系统也会自动采取措施来促成交易。同时 SD 机制可能根据不同的市场条件(如交易对的流动性和波动性等)采用不同的系数,这种灵活性和适应性超出了用户手动设置滑点所能提供的范围,尤其是在市场价格短时间波动较大的情况下。

但 SD 机制本身也有一定不足,例如在一个流动性储备不足的交易池中某一笔大额交易可能会显著影响该池的代币价格,0.15% 的预设滑点不足以应对这种变化,从而导致该笔交易失败。

流动性节点 / 流动性供应商:

在交易执行过程中,Orion 通过其虚拟订单簿将订单分派给特定的流动性节点。为了维持网络的去中心化特性并提高效率,Orion 引入了代理证明流动性 (DPoL) 机制。

通过此机制,流动性节点需质押 ORN 代币参与,其中质押量较高的节点更有可能被选择执行交易。但是这一选择过程不仅考虑质押量,还评估节点提供的代币种类、所在区块链网络及其储备情况,以确保交易能够顺利执行。

DPoL 还允许用户通过将 ORN 代币委托给特定的流动性节点来参与决策,从而影响节点的选择。这一过程旨在平衡用户和节点的利益,通过允许节点设置交易费用并与用户分享收益,增强了网络的去中心化和用户参与度。

资产安全与自主权:

在资产安全与用户控制权方面,Orion Terminal 提供了一种直接从用户钱包进行交易的模式。通过流动性聚合器,用户实际上是订单委托方,其通过 Orion 创建订单后,聚合器与流动性节点交互以供承接。每个订单的订单地址,交易平台及订单数量等信息都是公开可查看和可验证的。

这种模式强化了资产的安全性,确保用户的资金始终在其直接控制之下,减少了传统中心化交易所存在的资金盗窃和滥用风险。即使 Orion Terminal 发生故障,流动性节点网络和智能合约仍正常运行,允许用户继续通过 Orion 的流动性和经济服务参与交易。

这一设计体现了去中心化理念的核心,即用户无需信任任何第三方就可以安全、自由地进行交易。

3.1.2 Transmuted AMM Price Curves:以 CEXs 的交易方式使用 DEXs

传统来说,去中心化交易所 (DEXs) 如 Uniswap V3 采用自动做市商(AMM)机制,用其价格曲线来确定价格,这与中心化交易所(CEXs)使用的订单簿买卖订单清晰列出便于比较和交易的方式不同。AMM 价格曲线使得直接比较其流动性与中心化交易所的订单簿变得困难。

Orion 的创新之处在于,它将 AMM 的价格曲线转换为传统的订单簿形式,像 Uniswap V3 这样的 AMM 流动性就可以像在 Binance 或 OKX 等中心化交易所那样显示和比较。

这一转换不仅使价格比较变得更加容易,还允许在 AMM 上设置限价订单,增强了交易空间。此外,通过将 AMM 价格曲线转换为订单簿,Orion 确保了 AMM 的流动性可以与 CEXs 无缝集成和比较,为用户创造了一个统一的交易平台。

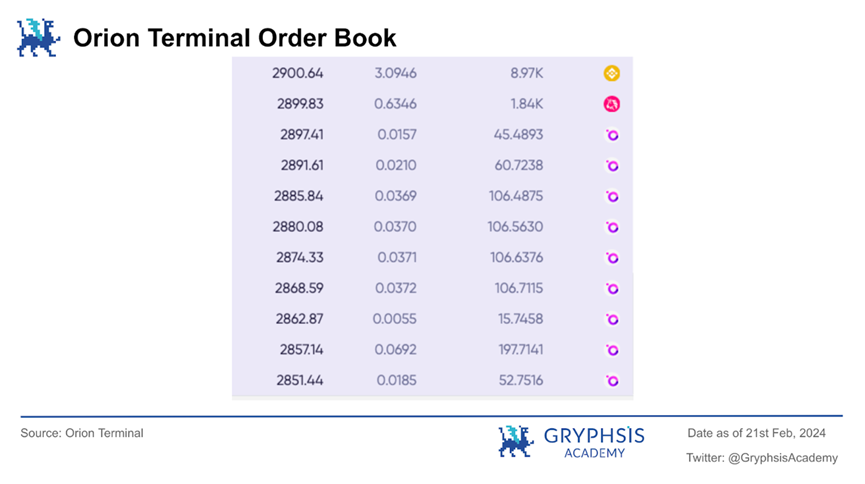

3.1.3 Virtual Order Books:结合 DEXs 与 CEXs 订单簿寻找最优价格路径

虚拟订单簿 (VOBs) 结合了传统订单簿(OOB)的直接交易方式和自动做市商(AMM)的流动性模型,创建了一个统一的交易平台。VOBs 不仅显示直接交易的信息,还能揭示通过多步骤 swap 实现更有优势的潜在流动性。

例如,通过中间代币(Token B)将代币 A 交换为代币 C 的交易。连续计算复杂的 swap,意味着它可以不断地更新和优化交易机会,为交易者提供新的和有竞争力的价格,以及之前可能未被发现的套利机会。

综合以上三种关键性技术,Orion Terminal 无疑成为流动性聚合交易产品的初步理想形态,当然,其具体的可靠性与价值发现能力还有待市场验证。

3.2 Orion Bridge

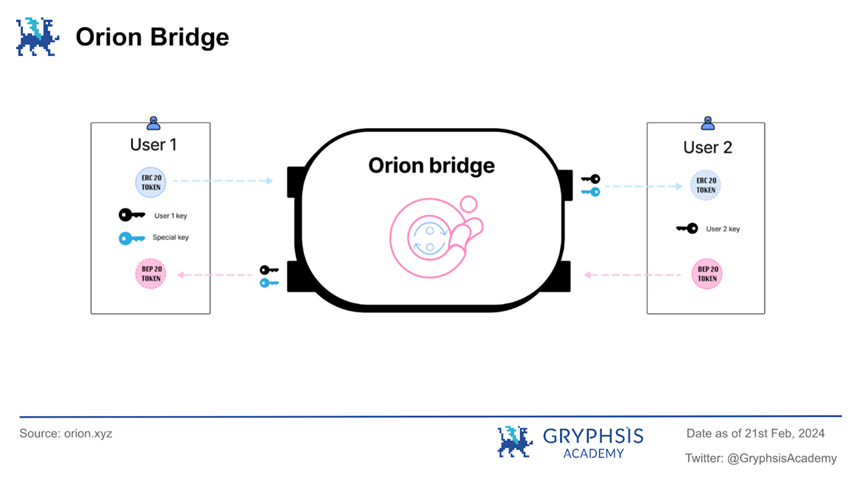

Orion Bridge 一定程度上解决了加密货币市场中跨链交易的挑战,实现了一个真正高效的去中心化跨链桥。这一技术的核心在于它的集成方式,首次将跨链、跨交易所的流动性聚合直接嵌入到 Orion Terminal 的后端,从而为用户提供了一个无缝、快速且安全的交易环境。与现有的 Bridge 相比,Orion Bridge 提供了一个无限制、无延迟、无订单拒绝、无资金锁定和无被利用风险的交易体验,很大程度上解决了市场上其他跨链桥存在的诸多问题。

Orion Bridge 由三项核心技术支撑:原子交换(Atomic Swaps)、点对点网络(P2P Network)和经纪人网络(Broker Network)。原子交换允许在不同区块链上的两个资产进行即时交换,无需包装资产或延迟。P2P 技术实现了真正的去中心化,即资产直接在个人间交换,无需中心机构介入。而经纪人网络确保了交易的即时性和流畅性,无论交易规模大小。

Orion Bridge 的第一次迭代中,已经实现了以太坊和 BSC 之间的无缝连接,并将在近期推出 BRC20 跨链桥,使得 BRC20 代币能与 MATIC 和 BSC 等 EVM 兼容链进行交易,值得注意的是,ORN 是币安上架代币中唯一一个具有 BTCfi 概念的代币。

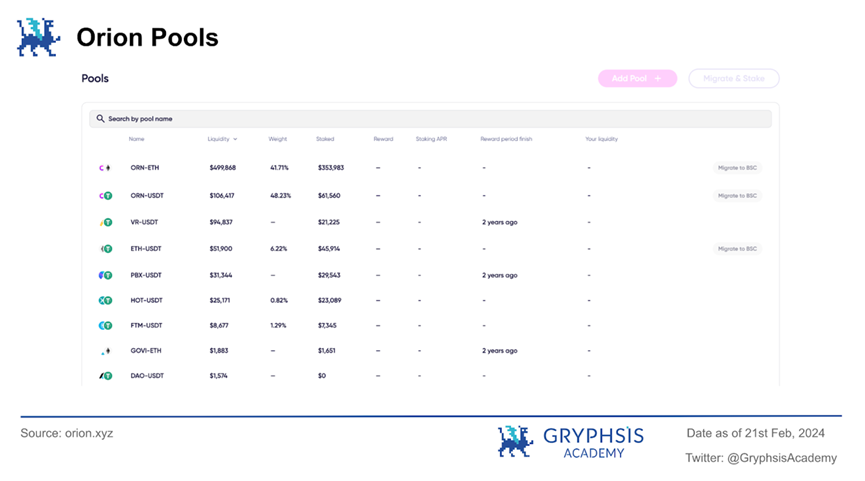

3.3 Orion Pools

Orion Pools 是一个基于 Uniswap V2 模型构建的去中心化流动性池平台。该平台允许用户不仅可以贡献流动性、创建新的流动性池,还能够通过添加自定义标志来个性化他们的体验,从而确保了一个活跃和充满活力的交易环境。

Orion Pools 的设计理念体现了对用户赋能的重视,通过简化的用户界面和流程,赋予用户创建、贡献及自定义流动性池的能力。

在操作流程上,Orion Pools 提供了直观的指导,使用户能够轻松地创建新池或向现有池添加流动性。创建新池的过程包括选择或添加新代币、建议与 USDT 配对以确保跨 Orion 平台的整合、上传代币图标(对于新代币),以及完成交易以确认新池的创建。贡献流动性的过程则包括选择偏好的池、输入贡献资产的数量,并通过钱包确认交易。这些过程不仅用户友好,而且增强了平台的流动性和交易效率。

通过向流动性池贡献资产,用户在促进平台上无缝交易的同时,还能获得交易费用中的一部分作为奖励,形成了一个互惠互利的关系。Orion Pools 不仅提供了获取收益的机会,还使用户能够成为更广泛交易生态系统的一部分,增强了用户的参与感和归属感。

随着新治理和流动性挖矿体系的生效,Orion Pools 正在向一个更加可持续和增长导向的模式转变。新体系自 2023 年 12 月 5 日起开始生效,强调了对协议增长和可持续性的支持,同时确保了与用户利益的一致性。这一转变不仅提高了平台的吸引力,还有望吸引更多用户参与到 Orion 生态系统中。

3.4 Orion Widget

Orion Protocol 推出的 Orion Widget 是一项创新的应用程序,专为加密货币交易平台和去中心化应用(dApp)开发者设计,旨在通过简化的集成过程,快速实现在任何网页或应用上的代币交易功能。该工具利用 Orion 的中心化和去中心化交易所(CEX 和 DEX)流动性,允许用户直接通过连接自己的钱包进行交易,从而提升了交易的便捷性和用户体验。

Orion Widget 的核心优势在于其高度的可定制性和易于集成的特性。开发者可以通过一系列预定义参数来定制 Widget 的外观和功能,包括主题风格、默认交易资产、可交易资产列表、初始交易金额和手续费资产等,以满足不同平台和用户群体的具体需求。这种灵活性确保了 Widget 可以无缝融入各种网页和应用环境,同时保持品牌一致性和用户友好性。

此外,Orion Widget 的集成流程极为简单,支持通过脚本和 iframe 两种方式集成,几乎不需要任何复杂的编码工作。这大大降低了技术门槛,使得即使是非技术背景的开发者也能轻松地在其平台上部署交易功能。此举不仅加快了开发周期,也减少了开发成本,为项目提供了更大的灵活性和扩展性。

在代币上市方面,Orion Widget 支持 Orion Protocol 已列出的数百种代币,并通过其广泛的流动性来源确保未列出代币的支持,进一步扩展了用户的交易选择。这一特性特别适合那些希望在自己的平台上提供特定代币交易服务的项目,无需担心流动性不足或代币支持问题。

4.增长点

4.1 Refer & Earn 实现用户快速增长

Orion Protocol 的 Refer & Earn 活动是一项旨在扩大其用户群体的计划。通过这个计划,Orion 鼓励影响力人物和忠诚用户推荐新用户加入,以 $ORN 代币作为奖励激励。参与者可以通过 Telegram 联系 @TradeOnOrion 申请加入此计划。

推荐人通过分享推荐链接,被推荐的用户在 @TradeOnOrion 交易时可享受 10% 的交易费用折扣,而推荐人则可以基于推荐产生的交易费用赚取高达 70% 以上的奖励。奖励通过 BNB Chain 的 $ORN 代币实时发放。随着计划的推进,将会开放更多机会给想成为推荐人的用户。

此外,推荐人活跃的推荐网络和高交易量不仅能获得基础奖励,还有机会在排行榜上获得额外的 $ORN 代币奖励。排行榜的排名基于网络在 14 天内的交易量和钱包中的 ORN 代币量。Orion 每月调整排行榜预算,以临时提高推荐奖励,奖励每小时发放,可在 BNB 链上领取。

这种基于奖励的推荐机制不仅能快速增加平台的用户基数,还能通过社区成员的自然社交网络扩散 Orion 的品牌,实现有机增长。社区成员因其推荐行为直接受益,这种互惠互利的关系增强了用户对平台的忠诚度和积极性。

同时,「Refer & Earn」活动通过交易费折扣激励那些通过推荐链接交易的用户,这不仅直接降低了用户的交易成本,也可能吸引更多的交易活动转移到 Orion 平台。随着交易量的增加,平台的流动性也将得到提升,从而吸引更多的用户和交易者,形成一个正向循环。此外,增加的交易活跃度还能提高平台的市场竞争力,吸引更多的项目方和合作伙伴关注和加入 Orion 生态。

通过实施多层次的奖励体系,Orion 鼓励了用户之间的连锁推荐,长期促进社区的活跃度和参与度。奖励的实时分发和基于排行榜的额外激励机制进一步增加了活动的吸引力,激发了用户的积极参与。这种长期的用户参与和社区构建对于平台的稳定增长和持续发展至关重要。

4.2 BRC 跨链桥及 BTCFi 的先行者

据 OrdSpace 数据显示, BRC20 目前已有多达上万种代币及高达二十多亿美元的总市值,该市场已经证明了其火爆和用户对此类资产的高需求。Orion 作为连接比特币和其他区块链网络(如 Ethereum、BNB Smart Chain 等)的跨链桥,是少数支持 BRC20 标准的基础设施之一,这给 Orion 提供了市场先行者的优势,有助于吸引早期采纳者和投资者。

此外,通过支持 BRC20 跨链桥,Orion 可以吸引那些希望在比特币网络上探索新金融产品和服务的用户和开发者。这种跨链功能将显著增加 Orion 平台的流动性和交易量。

BRC20 跨链桥的引入使 Orion 能够在比特币网络上支持可互换代币的创建和传输,从而为 BTCFi 生态系统的发展提供了重要基础。这不仅增加了比特币的用例和价值,还为 Orion 带来了连接 BTCFi 与更广泛 DeFi 生态系统的独特机会。

随着去年 BTC 生态的快速发展,我们预期 BTCfi 将会是一个快速发展的赛道,Orion 也可能因此通过其跨链桥产品具有较强的增长空间。

4.3 Orion Terminal 的 Airdrop 预期

2020 年 9 月,Uniswap 宣布空投其治理代币 UNI。所有在空投截止日期之前与 Uniswap V1 或 V2 交互过的 Ethereum 地址都有资格获得至少 400 UNI 的空投。

结合 Uniswap 的空投历史和成功经验,如果 Orion Protocol 考虑执行类似的空投策略,我们可以预见到几个潜在的增长点和积极效应,包括但不限于吸引新用户加入、促进社区治理与老用户参与度、提高项目曝光率、获取新的合作伙伴、获取有效用户反馈及促进其本身技术改进等。

5.代币经济模型

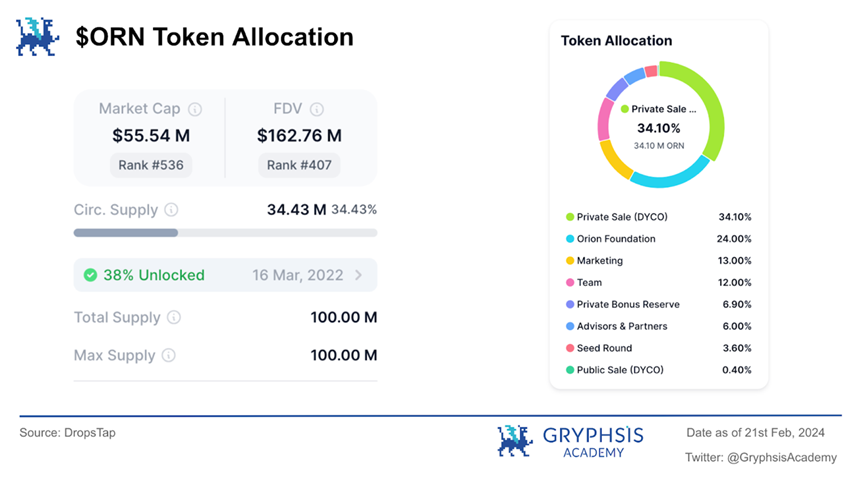

5.1 代币分配

5.2 代币效用

5.2.1 质押 & 治理

Orion Protocol 的治理 2.0 代表了其治理机制的一次根本性变革,旨在通过增强社区互动和影响力,构建一个奖励承诺并确保每个参与者都能为 Orion 的长期成功做出贡献的韧性未来。治理 2.0 的核心是引入了 veORN(Vote-Escrowed ORN),一个不可转让的代币,代表用户锁定的 ORN,等同于他们在 Orion 内的投票权和影响力。

初始阶段,veORN 主要用于流动性池的投票,但其设计灵活,随着 Orion 生态系统的发展,可能会扩展到新的治理能力。veORN 机制鼓励用户通过长期锁定 ORN 来增加其在 Orion 治理中的参与和影响力,从而强化了社区成员对平台发展方向的控制权。

用户通过将 ORN 质押并选择锁定期限来获得 veORN,进一步参与 Orion 的治理过程。锁定期限的选择反映了用户对 Orion 治理的承诺深度,较长的锁定期能够带来更多的 veORN,从而提升用户在治理决策中的影响力。这一机制旨在奖励那些对 Orion 生态系统有长期承诺的用户,通过一个精心设计的奖励系统,确保奖励与用户的参与程度和承诺深度成正比。

同时,治理 2.0 中引入的 veORN 衰减机制旨在激励用户持续参与 Orion 治理。随着时间的推移,未进行额外质押或延长锁定期的 veORN 会逐渐减少,这要求用户通过增加 ORN 质押或延长锁定期来维持或提升其在治理中的影响力。这种设计保证了 Orion 治理生态的活力和公平性,鼓励新用户参与同时奖励长期和积极参与的现有用户。

5.2.2 奖励机制

作为 Refer & Earn 计划中的激励:来自推荐人的费用生成(70% 的权重)和用户的 ORN 余额(30% 的权重)。较多的 ORN 余额可以显著增加收到的奖励。

6.风险

6.1 跨链桥技术安全风险

跨链桥项目在 DeFi 领域内存在较高的风险,包括安全漏洞和运营风险。Orion 作为一个跨链桥项目,需要高度重视这些风险并采取相应的安全措施和风险管理策略,以保护用户资产和增强社区信任。

6.2 系统集成风险

Orion 协议通过集成多个去中心化和中心化交易所来提供其独特的流动性聚合服务,这一过程涉及复杂的系统集成工作。尽管这种集成为用户提供了广泛的流动性访问和优化的交易体验,但它也带来了系统集成风险。

这些风险可能包括技术兼容性问题,即不同平台的 API 和数据格式可能存在差异,需要精细的调整和适配以确保无缝集成。此外,维护这种集成的稳定性和可靠性也是一个挑战,因为任何一个平台的更新或故障都可能影响到整个系统的运行。这种高度依赖外部平台的策略可能受到这些平台政策变化或服务中断的影响。

因此,尽管系统集成为 Orion 带来了显著的优势,如更丰富的流动性和更佳的用户体验,但同时也要求 Orion 必须投入持续的努力来管理和缓解这些集成风险,确保平台的稳定性和安全性,保护用户的利益不受影响。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。