Long-term trend

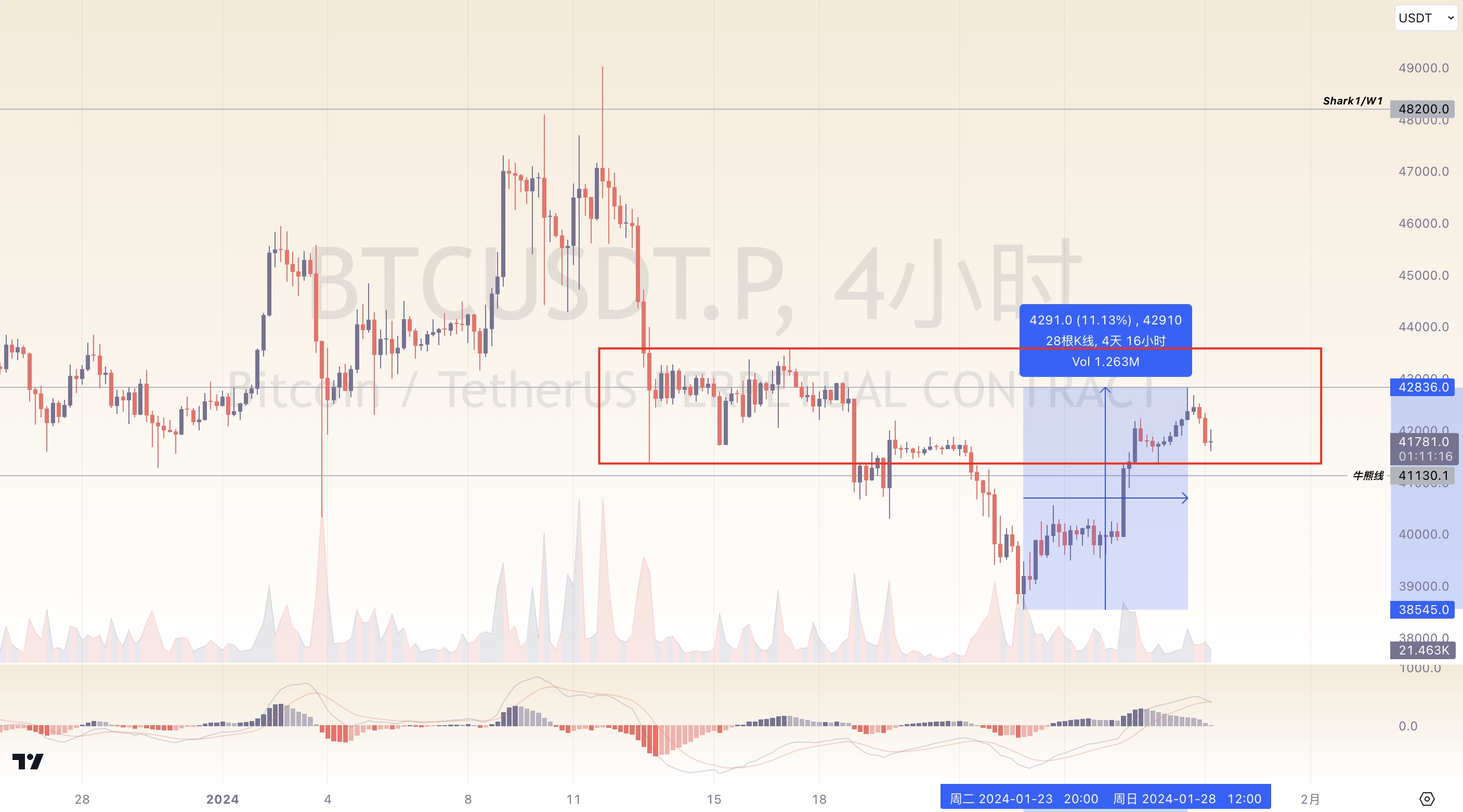

Although we did not release a video on Saturday and Sunday, due to the special market conditions this week, I have continued to provide daily market views in the group. In the previous video, I mentioned that Friday was the last turning point before the weekend and there might be a big move. As expected, a trend with increasing volume and price deviation started on Friday afternoon, which further confirmed our view of this upward trend as a pullback at the daily level. As the week was coming to a close, the price hit a strong resistance at 42836 and immediately faced selling pressure, leading to a decline. If the daily closing confirms a shooting star pattern, it most likely indicates that the pullback has reached its peak. It needs to be reiterated that my long-standing view of Bitcoin's long-term downward target at 36200 remains unchanged, and I once again remind everyone that it is not yet a good time to enter the market recklessly.

Medium-term trend

Although Bitcoin has shown a 7% increase in the mid-term chart over the past two days, it has not changed the overall downward trend in the larger cycle and the current strong bearish momentum in this cycle. Despite my earlier reminder of the strong demand for a Bitcoin pullback after reaching a low of 38545, the extent and strength of this rally have exceeded my expectations. Those who have profited from this trend are undoubtedly doing well, but personally, I still lean towards seeking short opportunities at high levels. If the market can maintain below the 42836 resistance and form a clear guiding downward structure in the future, it will undoubtedly be a very good short-term opportunity.

Short-term trend

In the short term, we can see that the market is relatively straightforward, with simple rallies, consolidations, further rallies, and then quick completion of the first wave of decline in the bull-bear rhythm. The subsequent strategy for seeking short-term opportunities is to wait for consolidation after the decline, as the structure provides opportunities.

Patience is the first digit of the wealth code. Welcome to join the Rabbit community.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。