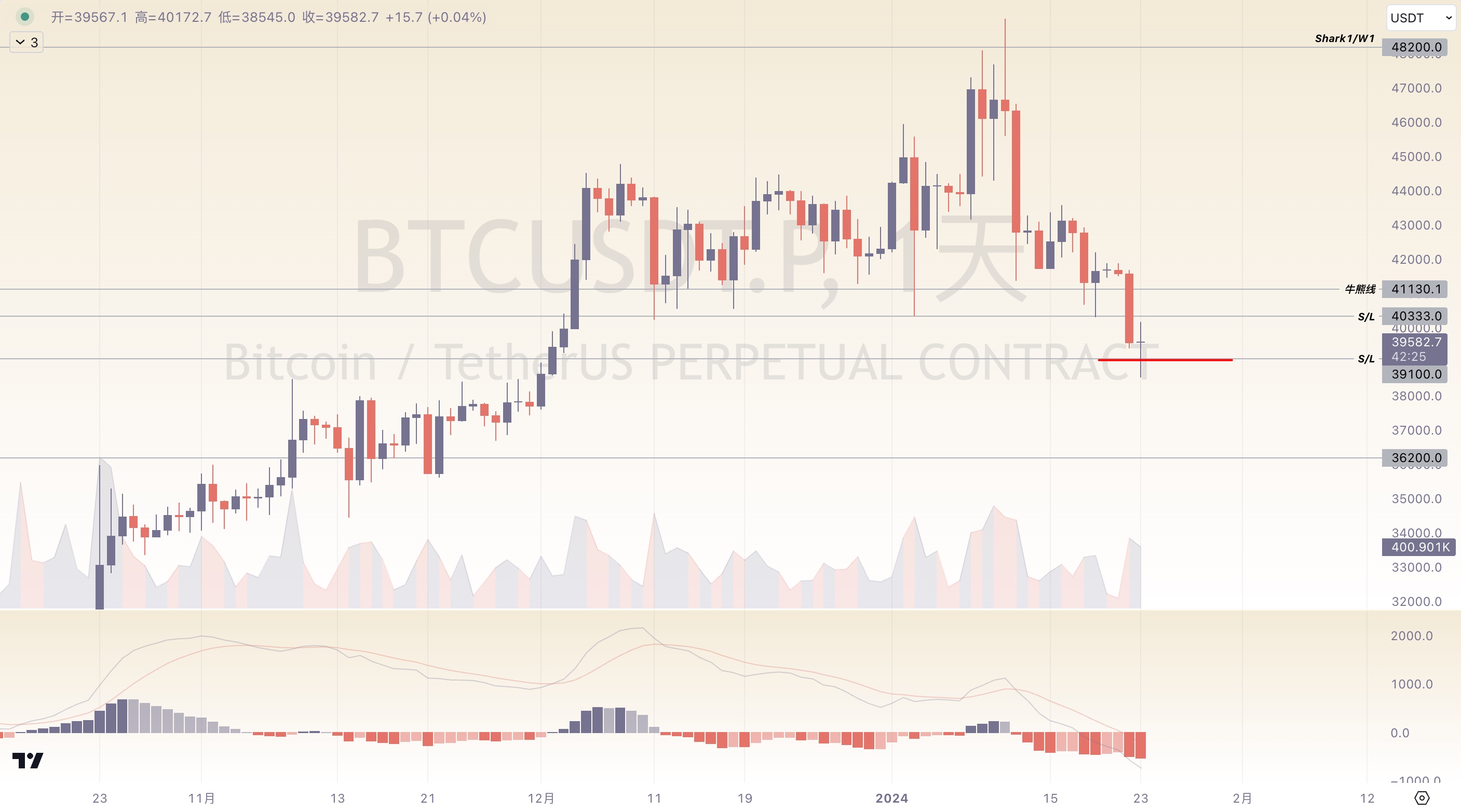

Long-term trend

Following yesterday's video analysis, Bitcoin did indeed continue to touch the support level of $39,100 and showed a clear sign of bottoming out. This aligns with our reminder yesterday that there is a demand logic for an upward rebound when this price level is reached. However, it is important to note that there is an increasingly strong call in the market for bottom fishing. Looking at the long-term chart, the most likely future trend is a period of consolidation and oscillation, followed by another decline to achieve our target of $36,200. The second most likely scenario is a direct waterfall decline. In summary, the least likely possibility in the long-term trend is the initiation of a new round of high breakthroughs, so it is best to dismiss the call for bottom fishing and be cautious about getting trapped.

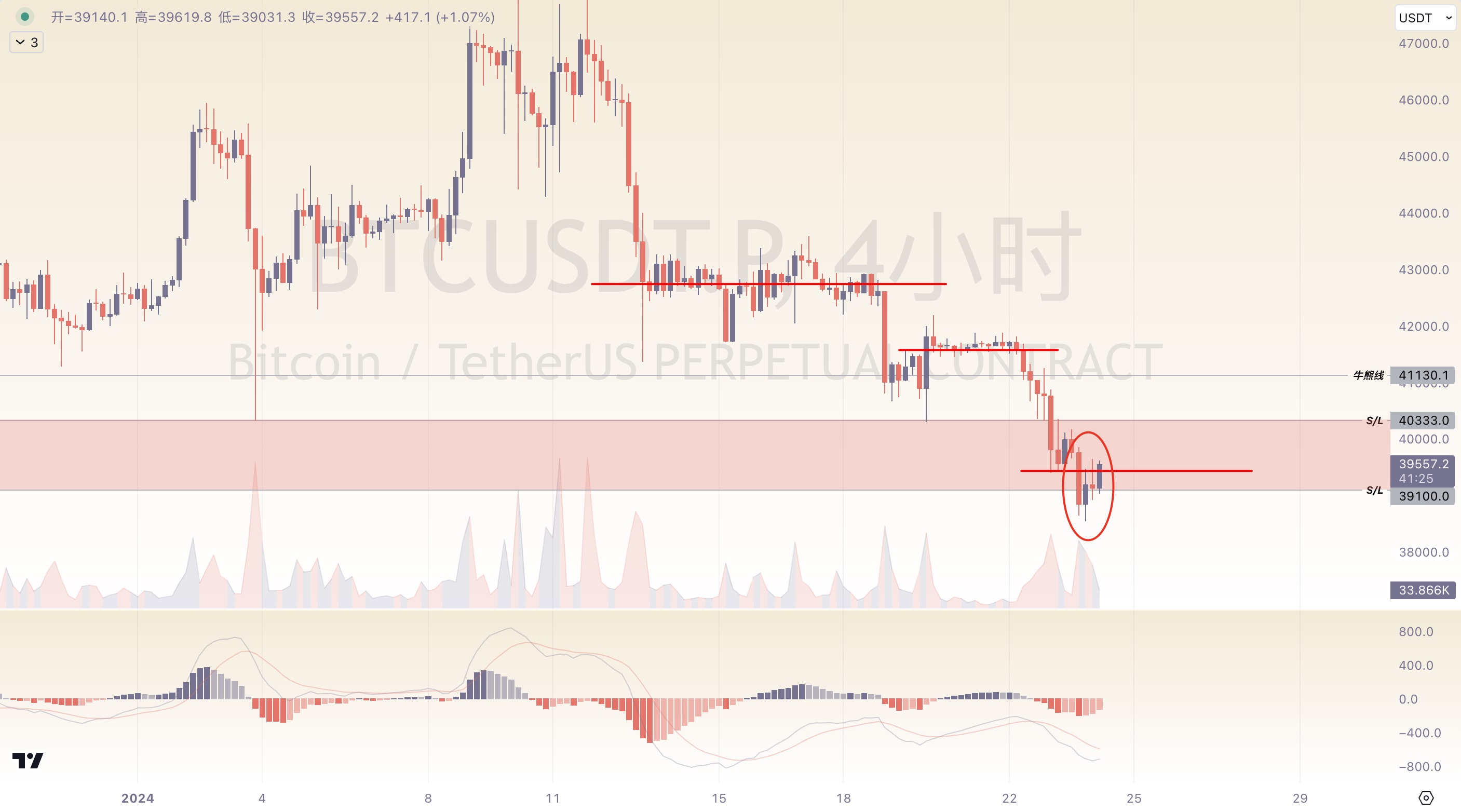

Medium-term trend

On the medium-term chart, we can see more clearly that after touching the $39,100 support level, the price formed a pattern similar to a piercing formation. Although it ultimately did not achieve a bullish counterattack against the bears, if the current candlestick closes with a small bullish candle, it will confirm the effective buying pressure. Given that the previous consolidation trends were characterized by sideways movements and showed relatively small and short-term fluctuations, we need to prioritize monitoring the resistance at $40,333 in the medium term. If this level fails to effectively block the bullish counterattack, the next target will be the bull-bear line.

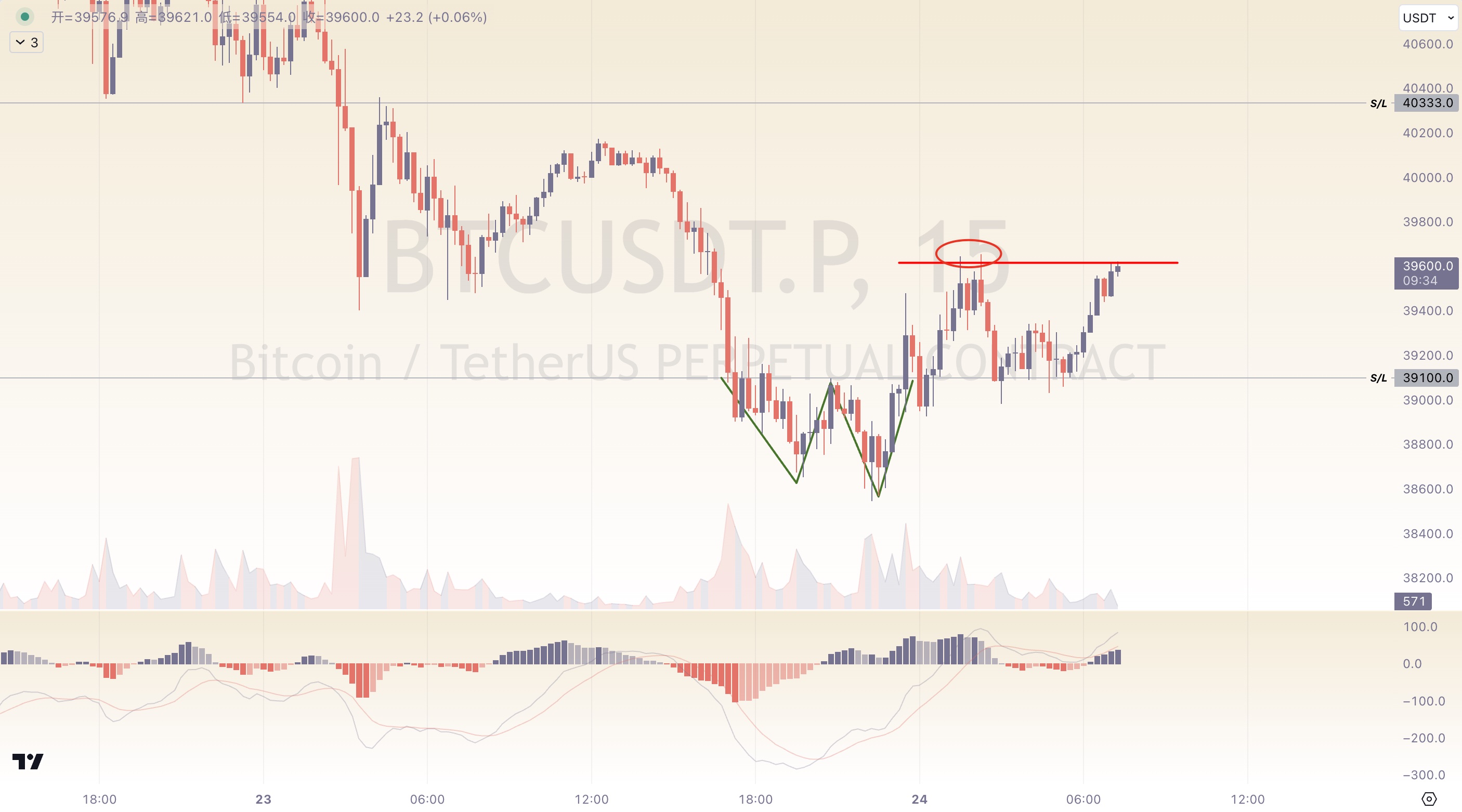

Short-term trend

On the micro-chart, we can see that the downtrend was terminated last night with a small "W" bottom pattern, leading to a shift in market sentiment from bearish to bullish. This coincides with our reminder in yesterday's video that it is necessary to patiently observe the short-term market structure. It is also quite evident that before the shift in market sentiment, the market quickly reached the profit-taking target. Going forward, we need to patiently wait for the completion of the shift in market sentiment, at which point clear structural opportunities will reappear.

Patience is the first digit of the wealth code. Welcome to join the Rabbit Community.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。