长期走势

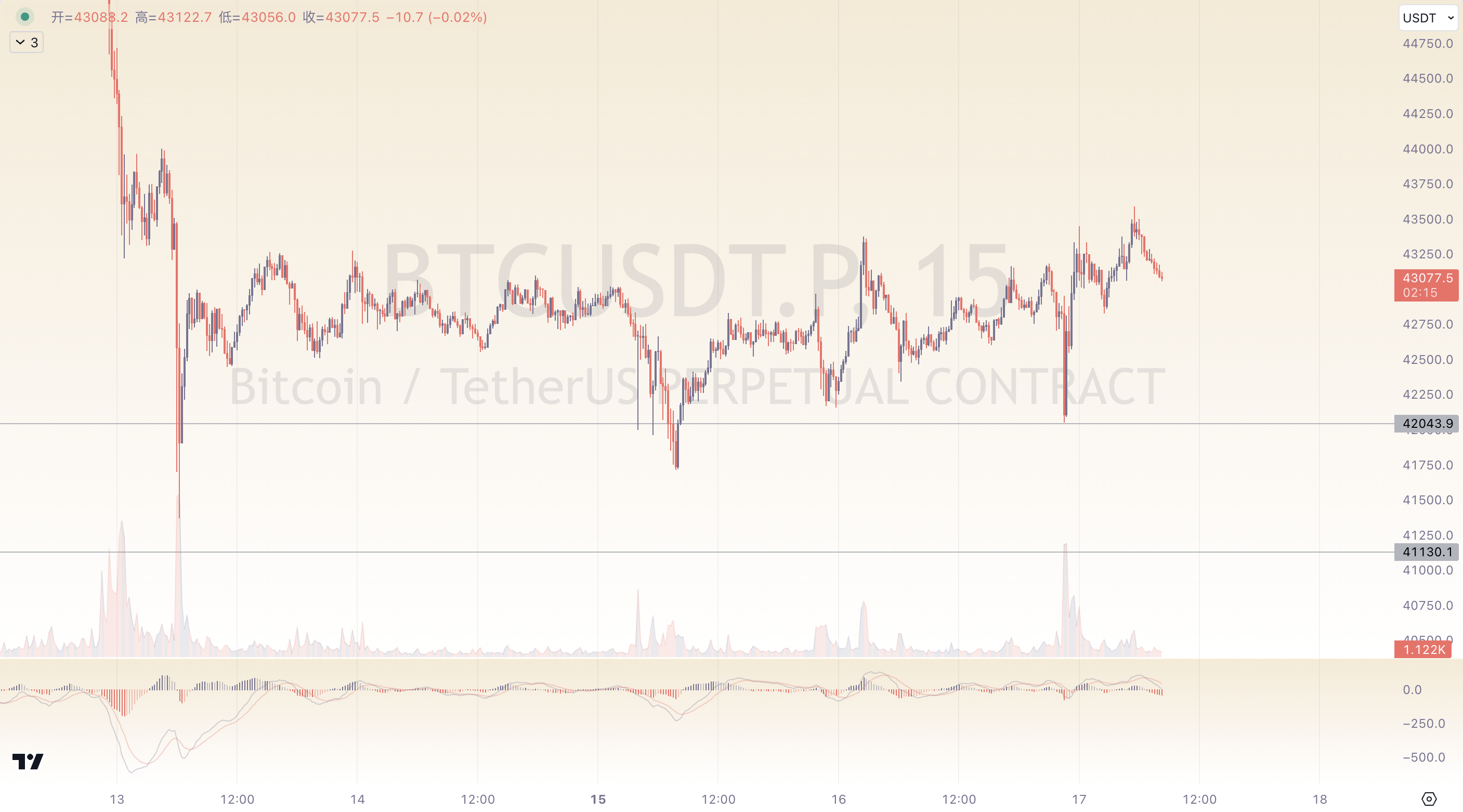

延续我们昨天视频的判断,比特币继续延续了震荡整理的表现。需要关注的是,虽然价格并没有太大涨幅,但却已经连续两天挑战了昨天视频中提到的43300阻力位,并且展现出多头量能的快速增加,说明最近的止跌行为已经开始让后市有向好预期的交易者放松警惕,这是空头主力喜闻乐见的场景,因此我们更需留意后续维持大周期的宽幅震荡走势,因为这不仅会对仓位带来磨损,也会对持仓心态带来更大的考验。

中期走势

从中期图表上看,在昨天的第二轮43300阻力挑战赛中,虽然价格仍然没能成功站上,但依托42044支撑收出了长下影线的纺锤线,也间接说明了卓有成效的多头防守表现。这无疑对中期的后续走势带来提振作用,但我们也不可忽视上方阻力重重且价格极度临近的情况。昨天给到的44000阻力位仍然不变,但44620阻力位已经通过一步步的多空交锋下移到了44500附近,接下来留给多头的时间会越来越紧迫,因为就当前的态势而言,震荡的时间越久,中期完成多向空的趋势转换的可能性就越高。

短期走势

短线上我们昨天画过一个潜在的三角结构,虽然昨天的预期是测试下沿并关注价格向下突破,但实际上价格只完成了下沿的测试,转而向上进行了两次佯攻。需要留意的是短线上低点不断抬高,高点破新高,代表当前已经处于上涨势。但从结构的角度看,潜在的三角结构未能最终成立,而对w底的预期也很吹毛求疵。从盘面看来,当前价格无论长中短线,还是多空视角,都不是很适合进场交易,稳健来讲观望是目前最合适的操作方式。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。