要说 2023 年除了比特币之外还有什么标的让人「大吃一惊」,必然有 Solana 一席之地。从 FTX 暴雷事件中慢慢恢复元气,Solana 市值排名又重回前五。为此感到高兴的除了 SOL 持有者,还有 Multicoin Capital。

作为 Solana 的早期投资者,Multicoin Capital 曾在 2021 年牛市期间获得高额回报,其以论文投研驱动的投资风格也颇受追捧。不过随着一系列事件导致 Multicoin 资产管理规模急速缩水,2023 年的投资数量仅为之前两年的四分之一。但去年年底加密市场回暖,不仅是 Solana,从 DePin 赛道的 Helium Mobile(MOBILE)到新公链 Sei(SEI),Multicoin Capital 投资组合中有许多资产标的都收获了可观的涨幅。

这值得我们对其保持关注,曾经风靡一时的 Multicoin 投资概念又来了?

Multicoin Capital 投资组合齐拉盘

去年 12 月,去中心化无线通信网络 Helium Mobile 代币 MOBILE 一周涨幅近十倍,带动整个 DePin 板块热度再现。

Helium 与 Multicoin Capital 的合作渊源已久,2019 年 6 月,Helium 完成 1500 万美金 C 轮融资,Multicoin Capital 和 Union Square Ventures(联合广场风险投资公司)领投。2021 年 8 月,Helium 宣布通过代币销售完成 1.11 亿美金融资,a16z 领投,Multicoin Capital、Alameda Research 等参投。

Helium 原生代币 HNT 在 2021 年从年中不到 0.2 美元的价格最高涨至 52 美元,成为 Multicoin Capital 当年最好的投资回报标的之一。2022 年 7 月,Helium 基金会推出新代币 MOBILE 作为 5G 热点的奖励,用以扩展 Helium 5G 覆盖范围。Multicoin Capital 联创 Tushar Jain 还发布长推解释 MOBILE 与 HNT 有何不同。截至撰稿时,MOBILE 价格为 0.0035 美元,24 小时涨幅达 27.9%。

提到 DePin 板块,就不得不提由 Multicoin Capital 投资的另一个 DePin 项目 Hivemapper。Hivemapper 是一个分散的、持续更新的地图,由人们使用行车记录仪构建。这种新的地图经济代表了人们拥有地图的方式的根本转变,以及与创建全球地图的人分享经济利益的方式。

2022 年 4 月,Hivemapper 宣布完成 1800 万美元融资,Multicoin Capital 领投,Solana 创始人、前苹果地图高管和 Helium 首席执行官等参投。1 月 4 日,Coinbase 将 Hivemapper 代币 HONEY 列入上币路线图。随后 HONEY 价格短时拉升至 0.26 美元,24 小时涨幅达 85.2%。

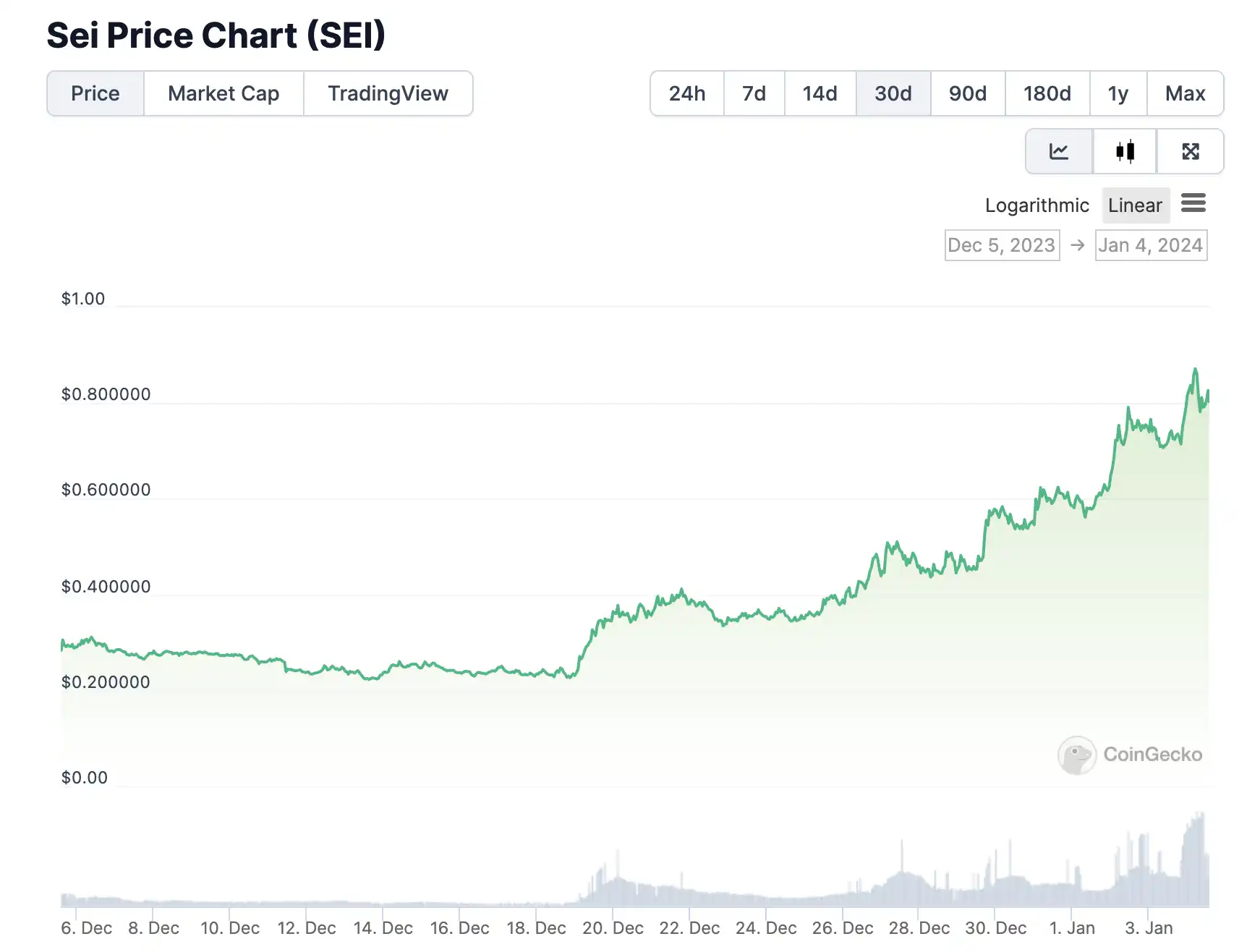

去年十二月以来,Multicoin Capital 另一个耀眼的投资标的是 Sei(SEI)。1 月 3 日晚间主流代币价格大瀑布后,SEI 短时突破 0.82 美元,截至撰稿时价格为 0.77 美元。

Sei 作为新一代 Layer 1 公链,自今年 8 月主网上线以来就因其强大的融资背景而备受关注,其中就有靠公链投资起家的 Multicoin。2022 年 8 月,Sei Labs 完成 500 万美元种子轮融资,Multicoin Capital 领投,Coinbase Ventures、GSR 等参投;2023 年 4 月,Sei 宣布以 8 亿美元估值完成 3000 万美元融资,Multicoin Capital、Jump Capital 等参投。

Sei 在去年 11 月底宣布将在今年采用并行 EVM 技术以升级 v2,而并行 EVM 叙事被多家投研机构认为是 2024 年的重点关注。如果 Sei 可以继续保持当前价格走势,对于 Multicoin 来说又是一个收益率很高的投资标的。

相关阅读:《两周近四倍,Sei 是下一个 Solana 吗?》

另一个近期获得价格涨幅的 Multicoin 投资标的是永续合约协议 Perpetual Protocol。1 月 3 日,截至撰稿时,Perpetual 原生代币 PERP 价格最高涨至 2.1 美元,24 小时涨幅超 60%。

2020 年 8 月,Perpetual Protocol 完成了 180 万美金融资,Multicoin Capital 领投。Multicoin Capital 联创 Kyle Samani 曾撰文介绍 Perpetual,称其融合了 CeFi 和 DeFi 的优势,有永续合约交易员期望的 CeFi 式杠杆,以及 DeFi 系统 AMM 提供的流动性和简便性。

《Multicoin:简述 DeFi 永续合约协议 Perpetual Protocol》

简单盘点完近期 Multicoin Portfolio 中有价格涨幅的投资标的之后,我们还必须提及 Solana,这个曾经带 Multicoin Capital 登上巅峰的投资标的。

Multicoin Capital 的成败往事

Axios 曾在 2021 年 12 月 30 日报道,Multicoin 自 2017 年 10 月成立以来,其对冲基金资产飙升了 20287%,旗下首只风险投资基金在扣除费用后已返还给投资人超过 28 倍的收益,而其中投资回报最高的项目包括 Solana、Helium 和 Arweave。

2018 年 5 月,名不见经传的 Solana Labs 以 0.04 美元的价格出售了 7925 万枚代币,Multicoin Capital 是买家之一。2019 年,Solana 团队发起了五轮融资,其中四轮为私募融资。这些私募融资始于 2019 年第一季度,结束于 2019 年 7 月,当时 MultiCoin Capital 领投了 Solana Labs 2000 万美元的 A 轮投资。2021 年 6 月,Multicoin Capital 又参与了 Solana 3.14 亿美元的融资。

Solana 价格在 2021 年的牛市顶峰时曾接近 260 美元,其市值在 2021 年 9 月更是跃居第三位。截至 2021 年年底,自 2020 年 4 月 Solana 代币开始交易以来,Solana 的价格上涨约 21,609%,HNT 则从年中不到 0.2 美元的价格最高涨至 52 美元。而这仅仅是二级市场的利润倍幅,Multicoin 作为机构的实际盈利则更加夸张。

Solana TVL 走势图;图源:DeFiLlama

因此,Multicoin Capital 对 Solana 的三轮投资让其回报在当年加密 VC 中一骑绝尘。

2021 年,Multicoin Capital 在 5 月份为其第二只风险投资基金筹集了 1 亿美元,以及还为其第三只风险投资基金筹集 2.5 亿美元。同年 9 月,Kyle Samani 做客 FTX 播客表示 Multicoin Capital 当前资管规模已经达到了 40 亿美元。而随着其投资组合的代币价格仍在上涨,这甚至影响了 a16z、红杉资本等传统风险投资公司不惜改变投资结构以持有更多的数字资产。

与 Alameda、3AC 等技术流、资金流的投资风格不同,Multicoin 自创立之初便坚持「主题投资」,两位创始人 Kyle Samani 和 Tushar Jain 总是会撰文阐释每一笔交易背后的「投资逻辑」,他们敢于出手那些「背离主流」的项目,敢于买在分歧,重仓逆势,而这种投资风格也为基金后续的成功披上了某种「浪漫主义」的色彩——这种风格在 Solana 一役得到了巅峰的演绎。

但成也萧何败也萧何,2022 年 FTX 暴雷事件使 Solana 成为受影响最深的加密项目之一,其币价一度跌至个位数。因 FTX 破产事件,Multicoin 在大约两周内资产规模下跌 55%。除了 9.7% 的资产由 FTX 托管,损失还因其长期看涨 Solana 以及 Solana 生态资产,比如 Mango、持有 FTX.US 股权和未完成的衍生品合约。

2022 年 12 月底,曾以三箭资本债权人身份披露过诸多信息的 Soldman Gachs 在推特上表示,其刚刚从 Multicoin Capital 处收到了自己的 11 月份投资者声明,声明中称「在过去的 11 个月里,基金跌幅高达 90%」。

2023 年 3 月,Multicoin Capital 在公司年度投资者信件中表示,Multicoin Capital 对冲基金 2022 年亏损 91.4%,为其创立以来最差表现。近日,Kyle Samani 和 Tushar Jain 再次致信 LP 表示目前 Multicoin 基金资产管理规模中约有 10% 仍在 FTX 上等待提现。

相关阅读:《Multicoin 回撤 90%:不过是盈亏同源》

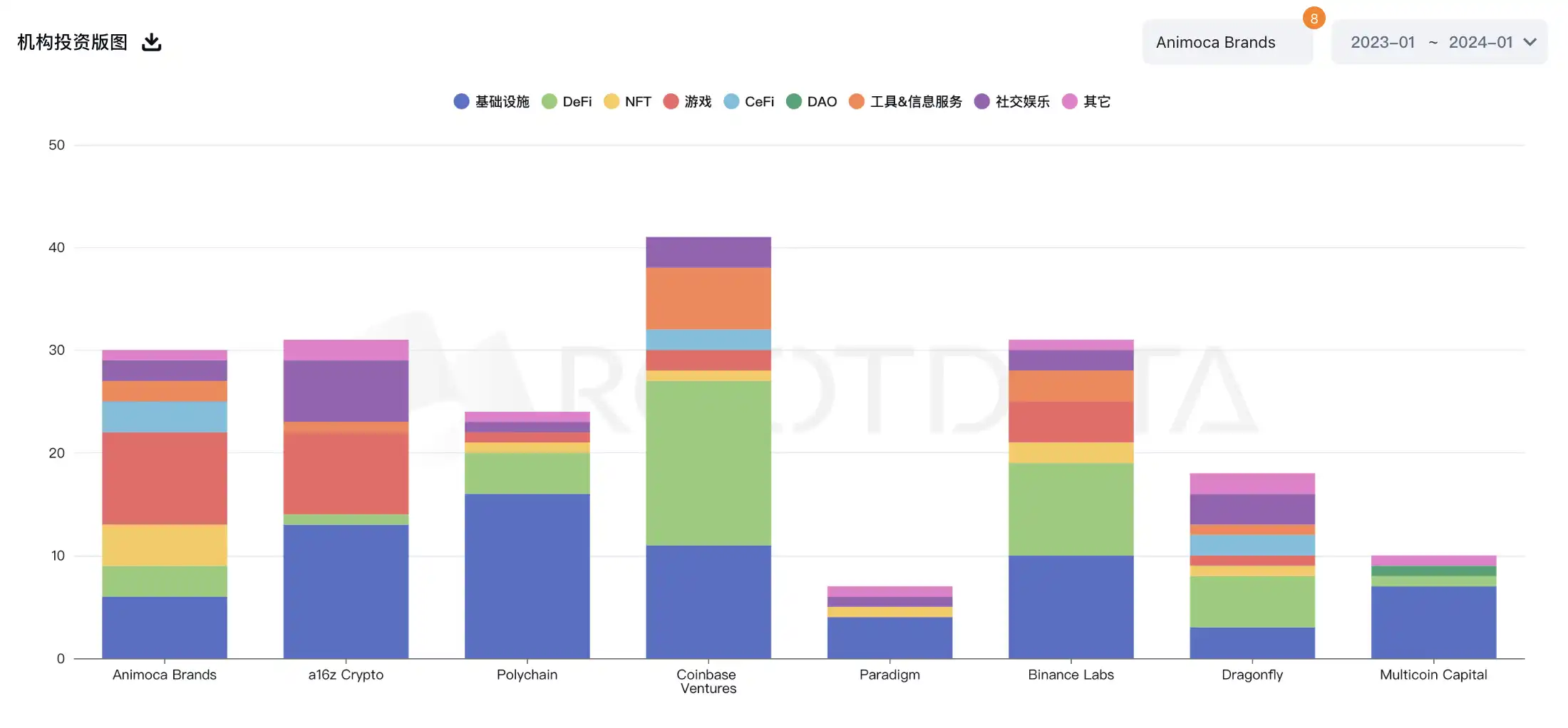

Multicoin Capital 就这样开启了其沉寂之旅,据 RootData 数据,2023 年,Multicoin Capital 仅有 10 笔投资,在主流加密 VC 中投资数量排名靠后。而 2021 年 Multicoin Capital 投资数量为 41 起,2022 年投资数量为 40 笔。

主流加密 VC2023 年投资数量对比图;图源:Rotodata

不过随着 SOL 价格回升、Solana 生态重焕活力,以及 Sei 等新公链崛起,这让 Multicoin Capital 的投资组合迎来新一轮上涨。据 CrunchBase 数据,目前 Multicoin Capital 的募集资金总额为 6.05 亿美元。2024 年加密市场是否还会迎来如同 Solana 之于 Multicoin 的投资回报我们不得而知,但我们可以提前了解 Multicoin Portfolio 里那些还未在代币价格上出现重大突破的项目,从而更好的把握下一轮牛市的黑马。

还需保持关注哪些 Multicoin 投资项目?

Multicoin Capital 联合创始人 Kyle Samani 在接受 Blockcrunch 采访时回答投新项目之前会做什么这个问题,他提到「会花费更多的时间分析市场结构,了解市场是如何运作的以及这个团队可以利用什么杠杆去前进。」而这正是保证 Multicoin Capital 在一众新项目之间能挑中黑马的关键原因。故此,BlockBeats 在其投资组合中盘点了几个值得关注的有潜力项目,更多项目读者可前往 Multicoin Capital 官方界面查询。

相关阅读:《Multicoin 联创 Kyle:Multicoin 是如何做投资的?》

Jito Labs(JTO)

2022 年 8 月 11 日,Solana 生态流动性质押协议 Jito Labs 完成 1000 万美元 A 轮融资,Multicoin Capital 和 Framework Ventures 领投,Alameda Research、Solana Ventures、Delphi Digital、Robot Ventures、Solana Labs 联合创始人 Anatoly Yakovenko、Coral 创始人和前 Alameda Research 工程师 Armani Ferrante 以及 Solana Foundation 通讯主管 Austin Federa 等参投。

Jito Labs 旨在提高 Solana 交易的速度和最终确定性,并为验证者和质押者提供奖励。2023 年 11 月,Jito 推出治理代币 JTO 并进行追溯性空投。

据 CoinGecko 数据,截至撰稿时,JTO 价格为 1.5 美元,市值为 1.81 亿美元,FDV 为 15.7 亿美元,排名第 246 位。

Worldcoin(WLD)

Worldcoin 的知名度想必不用过多介绍,其旨在为人工智能时代的人类提供数字身份证明。2021 年 10 月,Worldcoin 开发公司 Tools for Humanity 完成 2500 万美元 A 轮融资,Multicoin Capital、三箭资本等机构参投。2023 年 5 月 Worldcoin 完成 1.15 亿美元 C 轮融资,由 Blockchain Capital 领投,a16z、Bain Capital Crypto 和 Distributed Global 参投。

去年 12 月,Worldcoin 宣布推出 World ID 2.0 数字护照和高性能开发平台。据 CoinGecko 数据,截至撰稿时,WLD 价格为 3.22 美元,市值为 3.38 亿美元,FDV 为 310 亿美元,排名第 164 位。

Pyth Network(PYTH)

2023 年 12 月 5 日,预言机项目 Pyth Network 完成新一轮融资,Multicoin Capital、Wintermute Ventures 等参投。同年 11 月,Pyth Network 发起追溯性空投,其原生代币 PYTH 还参与了 BackPack 的质押活动。

据 CoinGecko 数据,截至撰稿时,PYTH 价格为 0.28 美元,市值为 4.18 亿美元,FDV 为 27.8 亿美元,排名第 140 位。

Marginfi

Multicoin Capital 投资的另一个值得关注的 Solana 生态项目为 Marginfi,2022 年 2 月,基于 Solana 的 DeFi 保证金协议 Marginfi 宣布完成 300 万美元融资,本轮融资由 Multicoin Capital 和 Pantera Capital 领投,Sino Global Capital、Solana Ventures 等参投。

目前,Marginfi 并没有推出其代币计划,但官方有一个积分活动被普遍认为是未来追溯性空投的依据,读者可自行前往了解。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。