Macro observation:

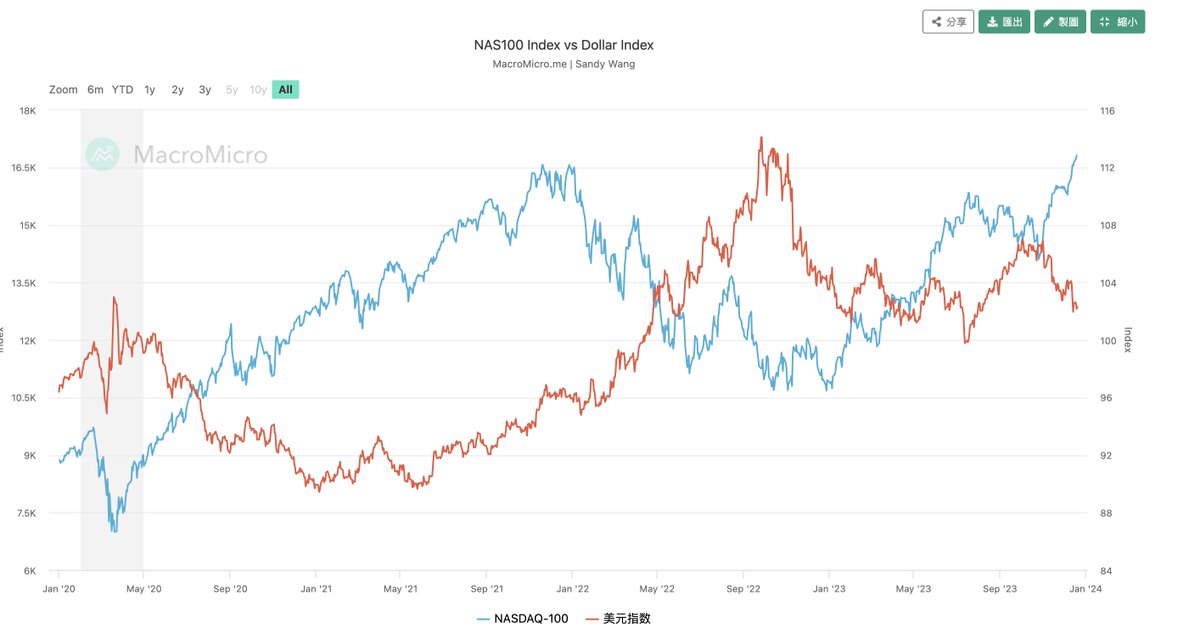

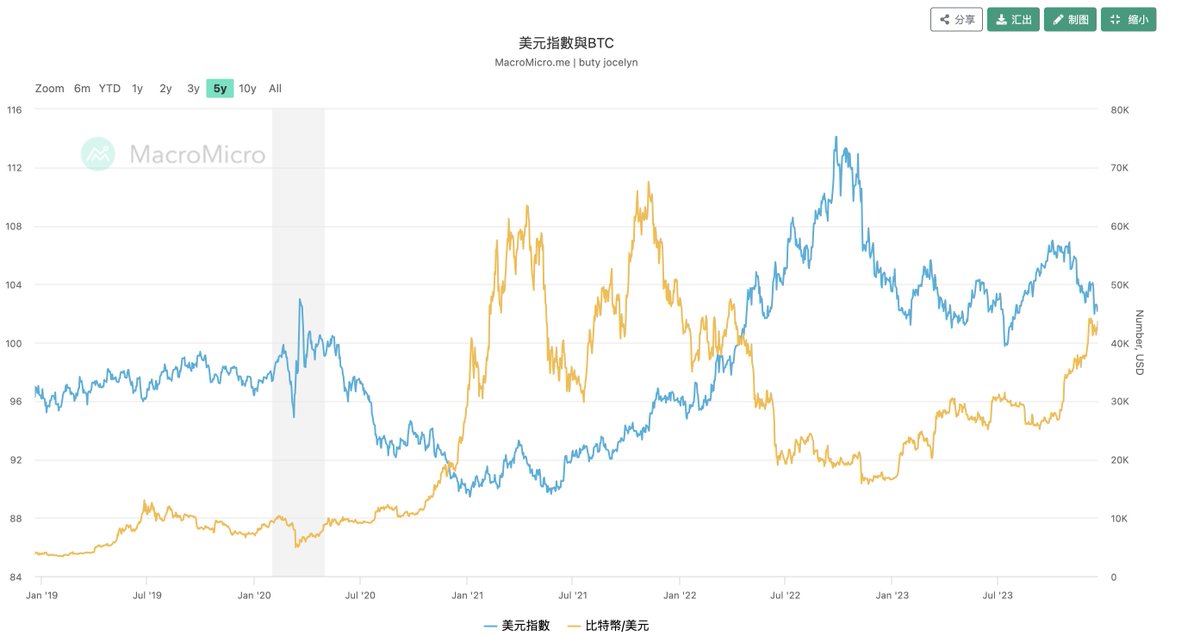

The downtrend of the US dollar index has been established. It is expected to reach below 100 in the near future. A comparison of the US dollar index with various risk assets shows that there is a negative correlation between the US dollar index and the prices of the Nasdaq and BTC. When the US dollar index falls, risk assets rise, and vice versa!

At the same time, the decline in long-term US Treasury yields has directly impacted early fixed-income investors (short-term US Treasuries, money market funds). From the perspective of risk preference, they will transfer funds from fixed-income products to equity and crypto assets. This is incremental overflow, so it can be seen that after the US stock market recovers lost ground in the past month, it continues to forge ahead, and there is currently no need to worry too much about crypto.

Always pay attention to macro dynamics, which is basically consistent with our 24-year forecast of major asset classes: https://t.co/xxr3Zw8fdE

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。