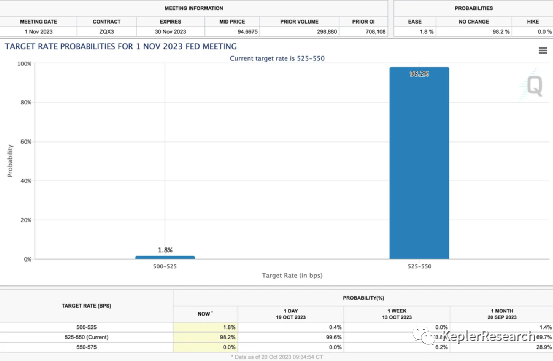

November 1st FOMC Meeting

Federal Reserve Chairman Jerome Powell delivered a speech in New York on Friday, and unsurprisingly, he took a more dovish stance, as the excessive leverage of the US government and the potential upcoming economic recession have become consensus in an uncertain world.

According to Powell's minimal discussion of future rate hikes, the Fed may be heading towards an economic recession. Currently, the market only expects a 1.8% chance of a rate cut by the Fed on November 1st. "Nevertheless, the current consensus in the market is that the Fed may continue to pause rate hikes until the first rate cut in June."

iShares 7-10 Year Treasury Bond ETF (IEF)

On Thursday, the 10-year Treasury yield broke 5.0% for the first time since 2007. As of last week, the US bond market is in the deepest and longest-lasting bear market in US history. The second worst bond market occurred with the outbreak of the US Civil War in 1861. The market clearly feels the impact of rising interest rates, and as the US government also seems to be feeling this impact, investors are fleeing "risk-free assets" in exchange for hard assets such as gold and bitcoin.

MBA Purchase Index

With the average 30-year fixed mortgage rate in the US breaking 8.0% this week, the demand for mortgage loans continues to shrink. The number of applications for single-family home financing has now dropped to the lowest level since 1995, and there are no signs of any slowdown. Due to the federal funds rate likely to remain at 5.25-5.50% or higher at least until the first half of 2024, we may soon see mortgage rates exceed 10.0%.

Nasdaq Index

As of the time of writing this article, 242 stocks hit 52-week lows today, while only 6 Nasdaq stocks hit new highs. With the prospect of rising inflation, large-scale war, and the possibility of continued non-competitive bond issuance, the index has set a net new low for 33 consecutive trading days. When looking at the basic price chart of the Nasdaq, this dynamic is quite evident, as market depth indicates that the foundation on which the Nasdaq is based may be crumbling. So far today, the Nasdaq index has successfully held the support level of about $12,960.

WGMI vs. BTC

Despite facing a difficult week in the market, the price of bitcoin has shown exceptionally strong performance, but the performance of publicly traded bitcoin stocks still lags behind spot bitcoin. Although PubCo is currently one of the only ways for investors to gain directed investment in BTC in brokerage or retirement accounts, it appears that institutions are raising cash from these names and deploying it into spot BTC or upcoming ETFs.

The chart below divides the price of BTC/USD by the price of WGMI, showing how BTC's performance has increasingly outpaced the Valkyrie Bitcoin Mining ETF since July 2023.

As stated in the article published on Thursday, "Bitcoin Spot ETF: The moment of approval is approaching, the market is filled with anticipation and anxiety!" — "Although the stock market has experienced a downward trend during the same period, the momentum of bitcoin has begun to slow down, but remains relatively stable.Bitcoin currently shows buying signals on the 1D, 12H, and 3H charts. Looking at historical data, October is the best-performing month for bitcoin, with an average return of around 20% in positive years, which is a significant figure.

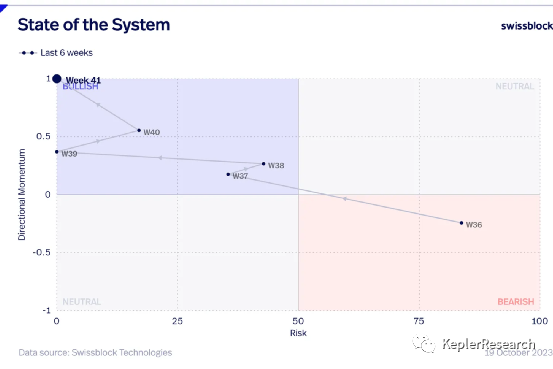

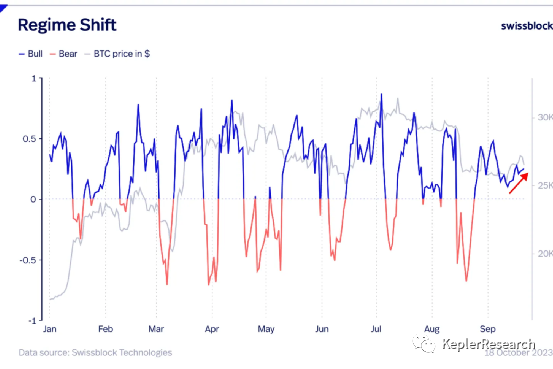

Technical Analysis

Bitcoin is moving full steam ahead, breaking through the long-awaited $28,000 range and maintaining a strong upward trend. We may face some resistance in the short term, but the mid-term outlook is stronger than ever.

Observing the change in the SEC's attitude, we can see that the environment has become optimistic. With increased interest and demand, we have finally broken the bearish trend that began on August 17.

Although the rumors of ETF approval successfully eliminated billions of dollars' worth of short positions and caused the BTC price to rise to $30,000 within minutes, we basically see that these trades have not been replaced. As investors seek the value of bitcoin as a safe haven in times of economic and geopolitical uncertainty, and speculate on the future of bitcoin before the approval of spot ETFs, the price trend is quite constructive.

If the price rises in the short term (with strong momentum to break through $30,000), then please pay close attention to the high point of about $31,900 since the beginning of the year, so that sellers can re-enter the market.

Note: All content represents the author's personal views and is not investment advice, nor should it be interpreted in any way as tax, accounting, legal, business, financial, or regulatory advice. Before making any investment decisions, you should seek independent legal and financial advice, including advice on tax consequences.

For more content, follow: KeplerResearch on Twitter @kepler008

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。