比特币在混乱中取得胜利,山寨币在 BTC 飙升的同时陷入困境,在全球不确定性的背景下,比特币依然坚韧不拔!

然而,对于目前正在经历低迷的山寨币来说却并非如此。这种下跌导致比特币在市场上的主导地位飙升至之前的峰值。

比特币的主导地位正在逐渐接近之前的高点。任何短期回调都可能导致更高的低点,一旦比特币的主导地位明显突破 52% 的门槛。有一些迹象表明比特币现货 ETF 的推出越来越近。

富达更新了其现货比特币 ETF(交易所交易基金)的申请。事实证明,这是与美国证券交易委员会 (SEC) 建设性反复讨论的结果。双方正在合作调整细节这一事实是积极的迹象,也意味着 SEC 热衷于让申请流程正确无误。

美国证券交易委员会积极参与确保申请的详细细节是乐观的。如果美国证券交易委员会倾向于拒绝 ETF,他们就不会费心处理文书工作的细节。

以下是富达申请现货比特币 ETF 的重大修改:

1.保管安排:该应用程序现在提供了如何安全保管比特币的更详细描述。

2.硬分叉机制:与潜在的比特币硬分叉(区块链分裂成两个独立链的事件)相关的程序更加清晰。

3.估值协议:富达强调其比特币估值和定价的来源,确保其符合GAAP (公认会计原则)

4.风险披露:一个增强的部分,深入研究各种风险,特别强调监管的不确定性。

5.环境影响:承认比特币挖矿的能源密集型性质,这一直是近年来讨论的话题。

与此同时,灰度比特币信托基金 (GBTC) 的折扣升至 -13.54 %,这一水平因异常低而引人注目。去年 12月它还处于-48% !

技术指标分析公司 Crypto Quant 最近发布了一条的推文。他们将比特币现货 ETF视为机构采用比特币的未来路径。他们认为,此类 ETF 的批准可能会使比特币的市值增加 1万亿美元。

宏观方面:

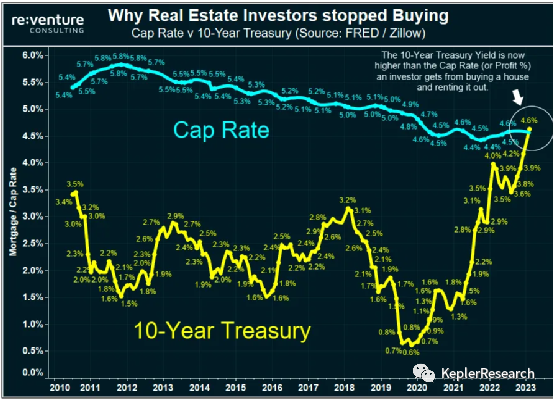

最新消息:根据 Reventure Consulting 的数据,10 年期国债收益率自 2008 年以来首次正式高于上限利率中位数。

简而言之,投资房产的回报率目前低于 10 年期国债收益率。毫不奇怪,今年投资者的购买量大幅下降 45%。随着利率继续上升,投资者将继续缩减投资规模。本周我们预计抵押贷款利率将达到 8%,到 2024 年初抵押贷款利率将达到 9 % 至 10 %。

注:所有内容仅代表作者个人观点,不是投资建议,也不应以任何方式解释为税务、会计、法律、商业、财务或监管建议。在做出任何投资决定之前,您应该寻求独立的法律和财务建议,包括有关税务后果的建议。

作者:更多内容 公·号KeplerResearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。