要点

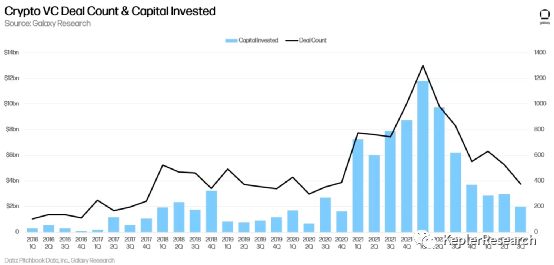

加密货币风险投资仍未见底。就完成的交易和投资总额而言,第三季度是 2020 年第四季度以来最低的季度。

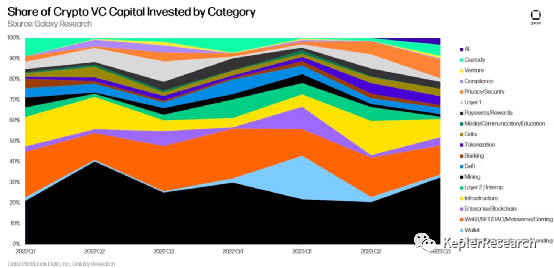

广泛的 Web3 类别中的公司在交易数量中占主导地位,而交易类别中的公司筹集的总资本最多。第三季度的结果延续了我们全年看到的趋势。对人工智能的兴趣要求在我们的数据集中创建一个新的部门,并且对人工智能和加密货币之间的重叠的兴趣不断增加。

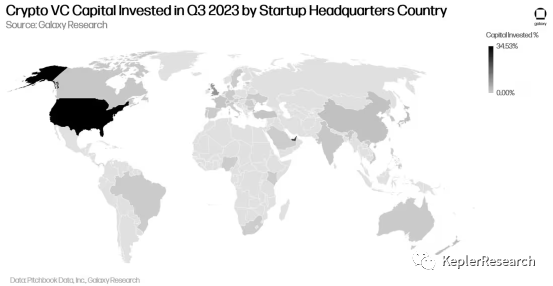

美国继续主导加密货币创业领域,但其他司法管辖区正在迎头赶上。虽然美国的加密初创公司占所有已完成交易的 35% 以上,并筹集了风险投资公司投资资本的 34% 以上,但美国现在在交易和资本方面的份额明显输给了阿拉伯联合酋长国等国家,新加坡和英国都有更先进的加密货币监管框架。

风险投资融资环境仍然极具挑战性,但可能正在改善。2023 年第三季度,风险基金筹集了超过 10 亿美元,这是自 2022 年第三季度开始下降以来的首次上升。新基金发行数量也从第二季度的 12 只增加到 15 只。基金规模中位数和平均规模较牛市高点大幅下降。

加密货币风险投资

交易数量和投资资本

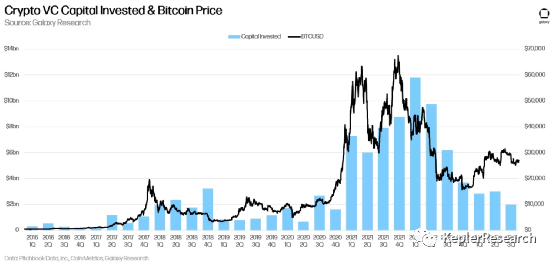

加密货币和区块链行业在 2023 年第三季度的投资额为 19.75 亿美元,创下了新的周期低点,也是 2020 年第四季度以来的最低水平,延续了自 2022 年第一季度 120 亿美元峰值后开始的下降趋势。加密货币和区块链初创公司在过去一年筹集的资金较少比 2022 年第一季度的总和高出 4 个季度。交易数量在此周期中也创下新低,仅为 376 笔交易。

公司总部的加密货币风险投资

尽管美国在交易数量和投资资本方面继续领先,但总部位于加密货币行业监管框架更为先进和明确的司法管辖区的公司在第三季度的这两个类别中都取得了显著增长。

2023 年第三季度,美国公司筹集了所有加密货币风险投资资金的 34.5%,其次是阿拉伯联合酋长国(23.5%)、英国(9.5%)和新加坡(6.2%)。

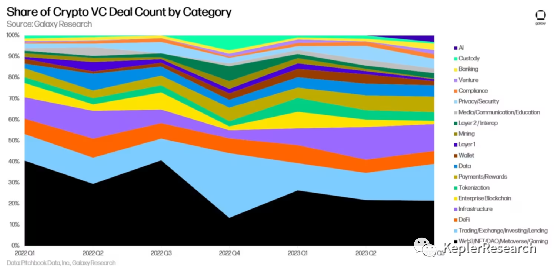

加密货币风险投资按类别

交易所、投资和借贷初创公司连续第三个季度筹集了最多的风险投资资金(6.11 亿美元,占所有风险投资的 32.5%)。Web3、NFT、游戏、DAO 和 Metaverse 初创公司连续第二个季度筹集了第二多资金(2.665 亿美元,占本季度部署的所有风险投资的 14.2%)。

交易所、投资和借贷领域的交易是本季度规模最大的一笔交易,Haqqex 获得了 4 亿美元的早期融资,这是一家自称“符合伊斯兰教法”的数字资产交易所。

Custody 在 2023 年第三季度完成了第二大交易,BitGo在 C 轮融资中筹集了 1 亿美元。我们的新人工智能类别显示,构建人工智能相关产品的初创公司在 2023 年第三季度筹集了超过 6000 万美元,占该季度部署的所有风险投资的 3.2%。

从交易数量来看,在 Web3 游戏、NFT、DAO 和 Metaverse 领域构建产品的公司继续保持领先地位,其次是交易、交易所、投资和借贷公司。这些趋势与 2023 年第一季度和第二季度相比没有变化。

加密货币风险投资熊市仍在继续。交易数量和投资资本尚不清楚市场是否已触底。高利率给风险投资行业带来广泛压力。其他重要结论包括:加密货币风险投资仍在熊市中、风险投资者面临融资环境的困难、创始人面临融资压力、美国的领先地位受到挑战。

注:所有内容仅代表作者个人观点,不是投资建议,也不应以任何方式解释为税务、会计、法律、商业、财务或监管建议。在做出任何投资决定之前,您应该寻求独立的法律和财务建议,包括有关税务后果的建议。

更多内容可关注:公众号 KeplerResearch 推特@kepler008

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。