值得注意的是,在 BTC 的短短 60 秒蜡烛中,所有未平仓合约的 6% (约 7,800万美元)令人震惊地消失了。好奇是什么推动了这种激增?

现货购买

比特币的购买行为 (现货溢价) 一直在持续。这导致交易所的融资利率降至负值。可以这样想:当市场有点过于悲观时,负资金意味着那些做空比特币(空头) 的人正在向乐观的人 (多头)支付费用。

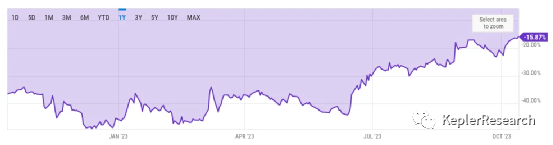

灰度比特币信托基金 (GBTC)

这是今年最小的折扣。现在,投资者可以以 15.87% 的折扣潜入并获得一块比特币。这比6月13日高达44.03%的数字要低得多。GBTC的价格与比特币实际交易之间的差距正在缩小。

有传言称折扣缩小是由于 SEC 选择不对 GBTC 案件提出上诉。因此,GBTC 折扣触及两年低点,人们感受到了 FOMO。市场分析师将此解读为现货比特币 ETF 即将推出的强烈暗示,彭博社分析师预测,到 2024年1月,现货比特币 ETF 获得批准的可能性为 90%。

比特币正在上下跳舞,触及更高的高点和更高的低点。从本质上讲,比特币现在正处于一个可能创下下一个更高低点的时刻!

比特币即将到来的高点将决定其走势要么飙升至4 万美元,要么暴跌至 2 万美元。鉴于一维均线的压缩,市场结构仍然基本看涨。

当价格回到 28,000 美元,或者超过这个数字并保持在那里,我们可能会看到一些更加偏向积极的信号。

近6%的未平仓合约在暴涨的第一分钟就被消灭了,随着市场开始对 BTC永续合约出价,大量空头被卖出。

但目前,主要是比特币的反弹,大多数山寨币都落后了,比特币的主导地位目前正在反弹,导致山寨币流血。话虽如此,自近期低点以来,某些山寨币 (如 SOL) 的表现优于大盘。我们需要关注这些山寨币,因为它们可能在下一个周期表现良好。

注:所有内容仅代表作者个人观点,不是投资建议,也不应以任何方式解释为税务、会计、法律、商业、财务或监管建议。在做出任何投资决定之前,您应该寻求独立的法律和财务建议,包括有关税务后果的建议。

作者:更多内容 公·号KeplerResearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。