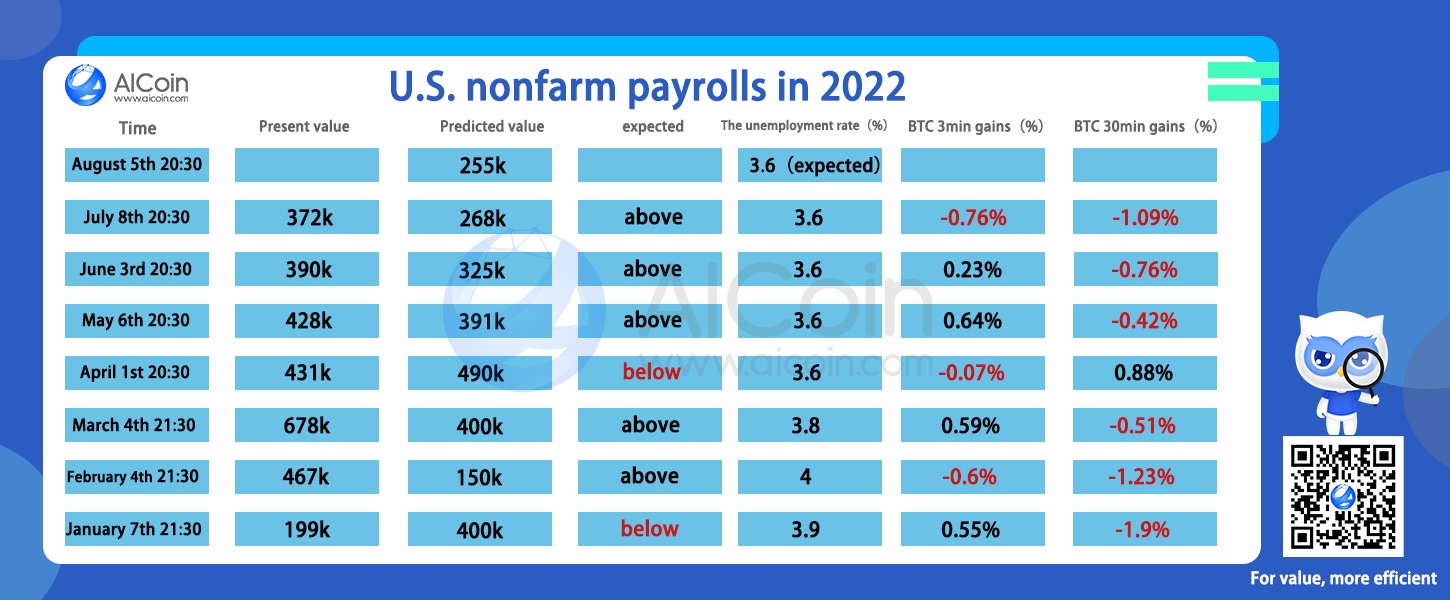

The United States will release July non-farm payrolls at Eastern Time 08:30, August 5. It is expected that the number of non-farm payrolls will increase by 250,000 in the month, a sharp decrease from 372,000 in June, and the unemployment rate will stabilize at 3.6 %, unchanged from June.

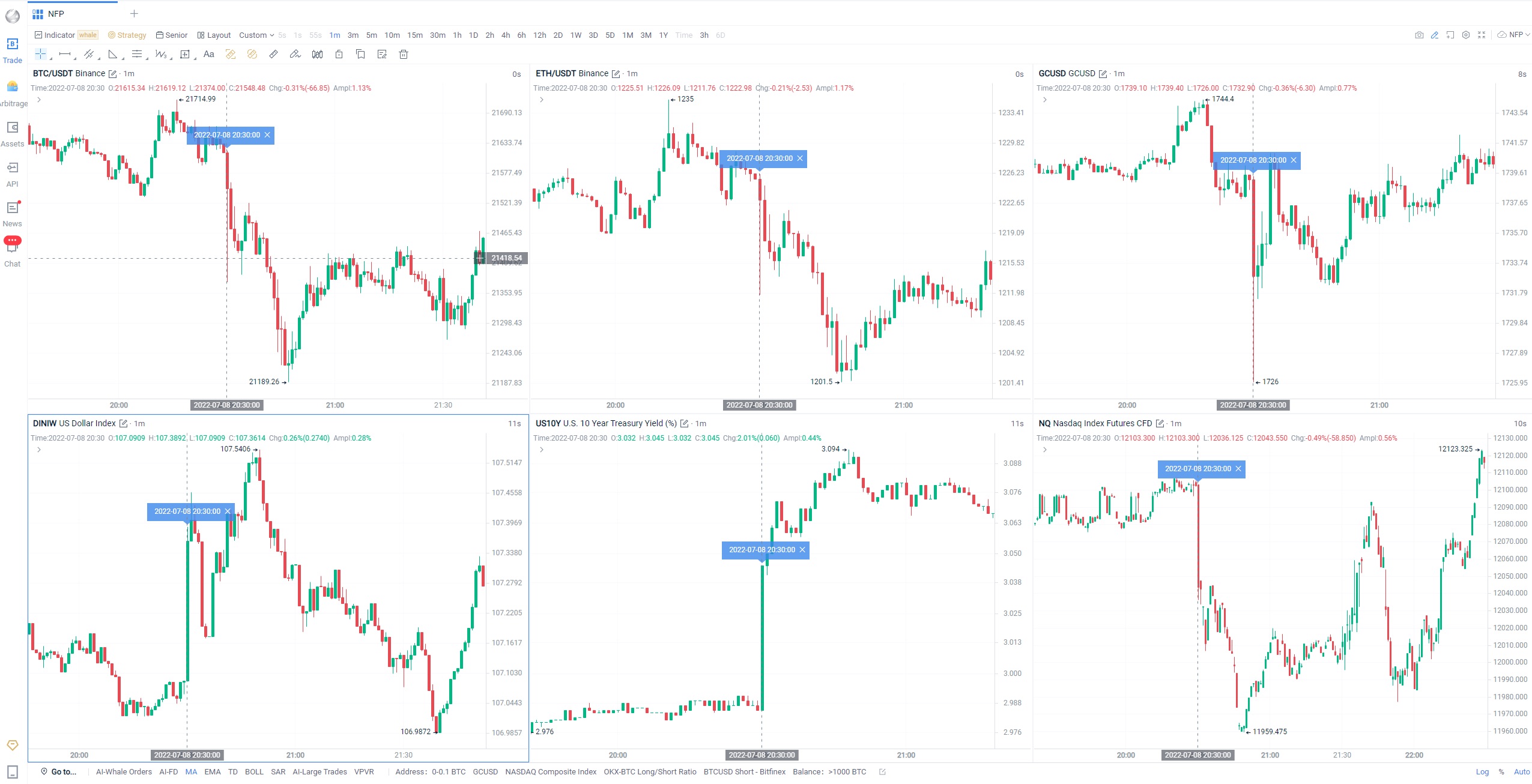

As far as the market is concerned, the announcement of the US non-farm payrolls data tends to bring violent market volatility to markets such as the US dollar, the stock market and cryptocurrencies. After the U.S. non-farm payrolls data was released last month, gold prices plunged rapidly, with the London Gold Index once falling to $1,726 an ounce, hitting its lowest point since October 1, 2021. At the same time, the Nasdaq futures index plummeted by -0.49%, the prices of Bitcoin and Ethereum also fell synchronously, with an amplitude exceeding 1.1%, while the US dollar index rose by nearly 28 points, and the US 10-year Treasury bond index rose 2.01%.

AICoin PRO live charts supports one-click jump to the specified date charts and custom multi-window function

AICoin PRO live charts supports one-click jump to the specified date charts and custom multi-window function

Historical data shows that the announcement of the US non-farm payrolls data has a relatively large influence on BTC price changes. According to this year's data, since the Federal Reserve started the rate hike cycle (January 27), if the non-farm data released by the United States is higher than expected, the price of bitcoin in the 30-minute cycle usually falls; if the non-farm data is lower than expected, the price of Bitcoin in the 30-minute period is on an upward trend. In other words, the direction of BTC price fluctuations in the 30-minute period is highly correlated with whether the non-farm payrolls is in line with expectations.

AICoin Pro live charts capture the whale dynamic in real time

Earlier, Powell said at a news conference that the U.S. labor market remained "extremely tight," indicating that labor demand is very strong and labor supply is restrained. The pace of employment growth has slowed slightly from before, but it is still strong. Overall, there has been some progress in balancing supply and demand in the labor market.

In addition, the Fed's Bullard and Mester both said at the beginning of this month that the labor market will maintain a good momentum. The U.S. labor market appears to be softening slightly, and the U.S. nonfarm payrolls report on Friday is expected to show job growth slowing to 200,000, JPMorgan said.

Some market analysts believe that due to the continuous announcement of layoffs by large companies in June, the non-farm economy has a greater chance of further weakening. If U.S. employment weakens again, it will further raise investor concerns about the state of the U.S. economy.

The analyst team of HYCM Industrial Investment (UK) pointed out that after the Fed's July meeting on interest rates, the market focus turned to the US economic data. Previously, the market was dominated by the Fed's interest rate hike expectations, and the movements of Fed officials could easily affect the market. However, the Fed has officially linked the future path of monetary policy to data, and the market will revert to a data orientation, especially the impact of employment and inflation data will increase.

Now, the non-farm data for July is about to be announced. At that time, the market will inevitably usher in another violent fluctuation. As the first major economic data after the Fed's July meeting on interest rates, this non-farm data report may become an important watershed.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。